| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 4.33% | 4.29% | 3.93% | 3.97% | 4.17% | 4.40% | |

Are rate cuts on the table - or off it

-

Rates are treading water this week

-

2-Year rates are higher today, but roughly unchanged from last week

-

10-Year rates are higher today too, but slightly lower from last week

-

Fed Funds and SOFR remain stuck at 4.30-4.35% until Powell moves again

-

Fixed swap rates are still saving borrowers 0.50%-1.00%

-

-

Sure, there’s been a slow drip of trade announcements and tariff reversals, along with the now-routine Trump attacks on Powell’s character—but markets seem to be taking it all in stride

-

The consensus right now is: there’s nothing new to price in

-

Everyone’s waiting for next week’s Fed meeting — expecting: no cut, tariff inflation is still a risk, economy is doing ok, and the job market is doing ok (I disagree, but that’s for next week’s email)

-

What I think matters more is the two-month stretch that follows

-

Between now and the next FOMC meeting in September, Powell will have to absorb two more job reports, two more inflation reports, and 49 days of growing pressure from the White House

-

That’s the window where things will get interesting

-

-

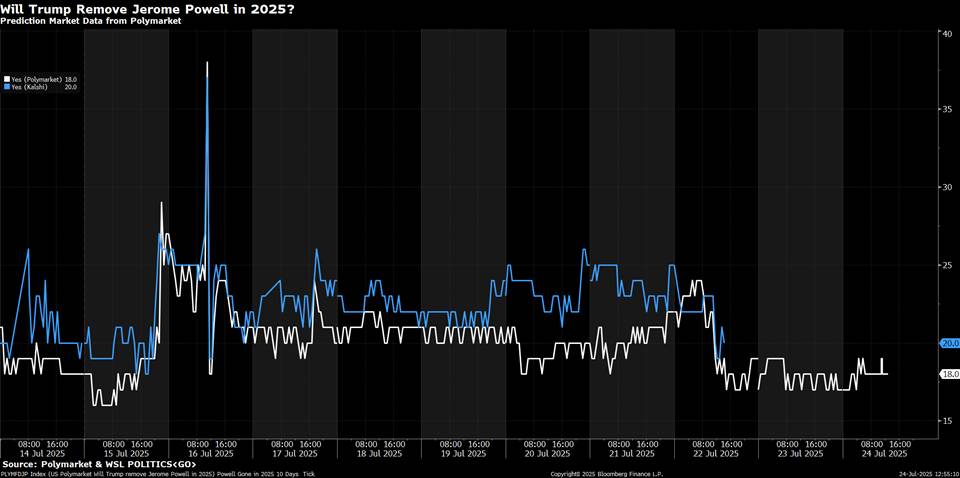

And on that note, yes, the Powell vs. Trump subplot is alive and well – they toured the Federal Reserve renovations this afternoon

-

Betting markets still see only a 20% chance Powell gets fired this year, and Kevin Warsh is still the front-runner to replace him if it happens

-

It’s not a high-probability event — but it’s a tail risk markets are watching closely

-

Source: bloomberg

Source: bloomberg

When will markets price in a Trump Fed?

-

That’s the rhetorical question I posed earlier this month, and it’s become more relevant since: If Powell’s replacement is being chosen for their willingness to cut, when does the rate market start front-running that?

-

There are hints that its already happening because so far, 2025 rate expectations haven’t budged since May

-

But what’s quietly changing is 2026 — traders are leaning harder into the idea that if the Fed doesn’t cut this year, they will next year, in size

-

The more Trump calls for 300 basis points of easing, the more traders sketch out a scenario where Powell either bends, or gets replaced by someone who will

-

-

That’s why the September meeting matters — but not because the Fed will move. It’s about the data we get between now and then

-

If inflation breaks higher, the 4–5 cuts currently priced in are too optimistic, and you’ll see fixed rates jump as the market unwinds those rate cut bets

-

But if inflation holds steady — or drifts slightly lower — the market will double down on the easing narrative, and swap rates will drift lower ahead of Powell’s replacement

-

My view: tariff inflation is real - but manageable

-

I lean toward that second outcome. Tariff inflation is nuanced. The pass-through is uneven, and I’d put it at 60% odds that the next two CPI prints come in mixed — not scary.

-

That gives Powell a reason to wait. But more importantly, it gives markets the confidence to price more cuts into 2026, regardless of what the Fed says next week.

Source: bloomberg

What does this mean for borrowers?

-

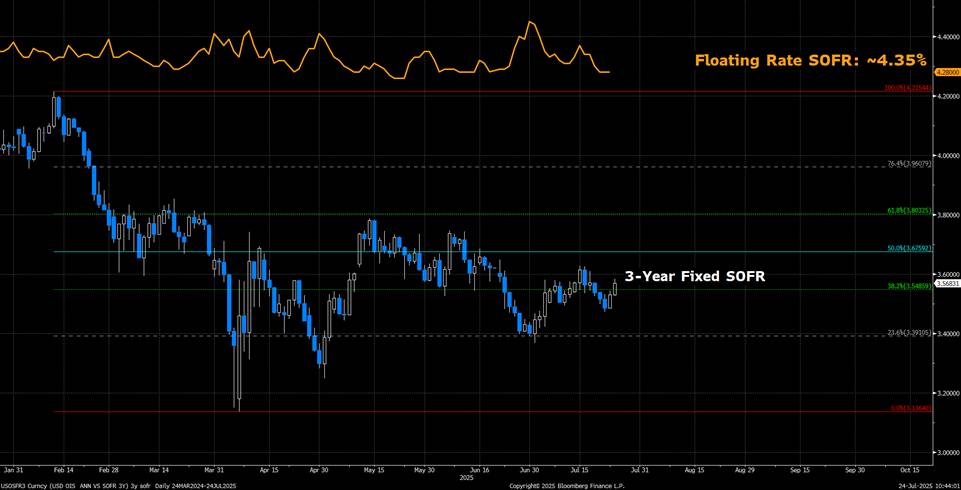

This is why I’ve been talking about 3-year fixed rate swaps for a while now:

-

On the way up, the best time to hedge is early — before hikes get priced in, and to use long term hedging strategies (10-year swaps)

-

On the way down, it’s the opposite — you want to target shorter hedging strategies (2 & 3-year swaps) and the best time to lock those in is after cuts are priced in

-

-

That’s exactly what’s happening now. If you can fix SOFR 75+ bps below where you are paying to float, you’re not just locking in a lower rate — you’re front-loading cuts the Fed hasn’t delivered yet

-

That’s also why layering in overtime remains today’s best practice:

-

As cuts get priced in, you add to your hedge

-

If rates rise? You’ve locked in value

-

If rates fall further? You have dry powder to capitalize

-

Source: bloomberg

This material should be construed as the solicitation of an account, order, and/or services and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers.

The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. (“SGI”) disclaims any responsibility to update such views. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

References to certain OTC products or swaps are made on behalf of StoneX Markets, LLC (SXM), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (CFTC) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ and who have been accepted as customers of SXM.

StoneX Financial Inc. (SFI) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (SEC) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to certain securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to certain exchange-traded futures and options are made on behalf of the FCM Division of SFI. Wealth Management is offered through SA Stone Wealth Management Inc., member FINRA/SIPC, and SA Stone Investment Advisors Inc., an SEC-registered investment advisor, both wholly owned subsidiaries of SGI.

StoneX Financial Ltd (SFL) is registered in England and Wales, company no. 5616586. SFL is authorised and regulated by the Financial Conduct Authority (FCA) (registration number FRN:446717) to provide services to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised and regulated by the FCA under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the FCA.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.

StoneX Financial Pte Ltd (Co. Reg. No 201130598R) (“SFP”) is regulated by the Monetary Authority of Singapore and is a Capital Markets Service Licensee (for dealing in capital market products), an Exempt Financial Adviser (for advising on investment products and issuing or promulgating analyses/ reports on investment products) and a Major Payment Institution (for cross-border money transfer service).

SFP may distribute analysis/report produced by its respective foreign affiliates within the StoneX Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations Recipients should contact SFP at (65) 6309 1000 for any matters arising from, or in connection with, this webinar.

StoneX Financial (HK) Limited (CE)No.: BCQ152) (“SHK”) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

StoneX Securities Co., Ltd. (“SSJ”)(Co. Reg. No 010401047199) is regulated by the Japanese Financial Services Agency as a Type-I Financial Instruments Business Operator (Kanto Local Finance Bureau (FIBO)No.291’), is a member of the Financial Futures Association of Japan for dealing and broking FX and FX Option transactions, and is a member of the Japan Securities Dealers Association for dealing and broking stock indices and option transactions.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

The report/analysis herein is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

© 2025 StoneX Group Inc. All Rights Reserved.