| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 4.33% | 4.29% | 3.91% | 3.98% | 4.18% | 4.42% | |

June Job Report Summary

-

The U.S. added 147,000 jobs in June, exactly in line with the 12-month trend and above market expectations

-

Yet private sector labor demand was soft, with government hiring accounting for nearly half the headline payroll gains

-

The unemployment rate dipped to 4.1%, while wage growth slowed to 0.2% MoM / 3.7% YoY

-

Underlying signals pointed to gradual softening, not collapsing: work hours fell, long-term unemployment rose, and discouraged workers increased again

-

Rates are trading higher, with a July rate cut completely off the table now and the odds of a September cut falling to just 70%

SOURCE: BLOOMBERG

SOURCE: BLOOMBERG

The Good News

-

The unemployment rate didn’t rise

-

4.1% unemployment gives Powell some breathing room — even if it’s being artificially suppressed up by a declining participation rate

-

None of the 77 economists in Bloomberg’s survey expected the unemployment rate to drop this morning

-

-

Wage growth is gliding lower

-

+0.2% MoM is the slowest since late 2021, and annual wage gains are now down to 3.7%, off the 4.5% highs from last year

-

That slowdown offers some comfort amid tariff uncertainty — less wage pressure means lower pass-through risk

-

-

Private hiring is orderly, not collapsing

-

We’re still adding jobs. It’s that simple. Despite only 74k of the 147k jobs coming from the private sector, its good enough job growth to keep “recession” out of the interest rate conversation

-

Sectors like health care (+39k), social assistance (+19k), and construction (+15k) continue to add jobs — which is what you want to see in a soft landing

-

The Bad News

-

The breadth of hiring was very narrow (again)

-

State and local government accounted for 80k of the 147k jobs, with 63k in education alone

-

To that end, Arlan Suderman pointed out an interesting caveat to this hiring too

-

This was largely a seasonal quirk — school summer layoffs were smaller and occurred later than the statistical models expected, so the algorithm turned a “smaller drop” into a “gain.” This effect is likely to reverse in the next 1–2 report

-

-

-

Jobs in retail, hospitality, transportation — flat to negative

-

These key consumer-linked sectors were flat to negative, not great for Q3 growth expectations

-

Meanwhile, federal hiring dropped another 7k (now -69k from January), so yes — DOGE is still leaving a mark

-

-

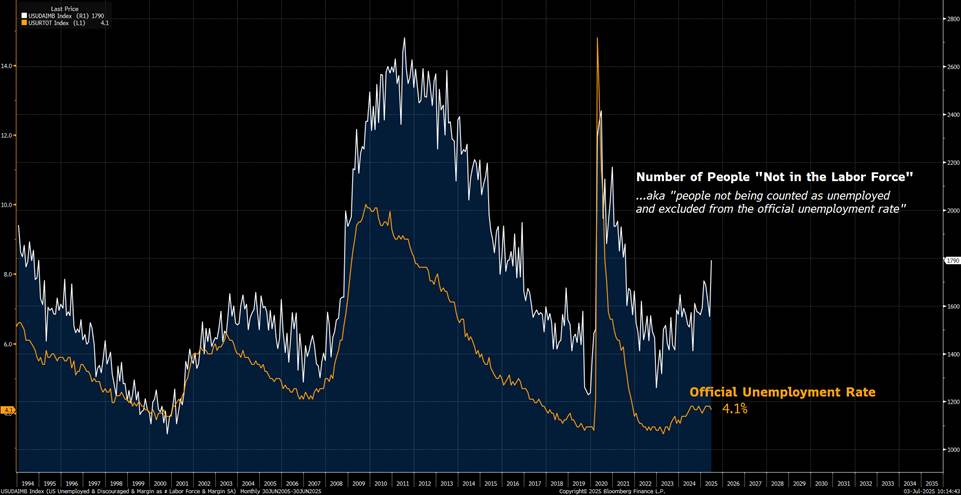

Labor force participation is falling

-

The labor force participation rate fell to 62.3%, down from its 2023 peak (62.8%) and well below pre-COVID norms

-

Further, long-term unemployment rose +190k, accounting for 23.3% of all unemployed — the highest since 2022

-

And discouraged workers surged +256k, pushing the not-in-labor-force total to 1.8 million – masking real weakness in the unemployment rate

-

Combined with this week’s JOLTS report — which showed more job openings but fewer hires — it’s clear that workers are disengaging, not just unemployed

-

As ADP’s Nela Richardson put it: “Though layoffs continue to be rare, a hesitancy to hire and a reluctance to replace departing workers led to job losses last month”

-

-

SOURCE: BLOOMBERG

All-in:

-

This is not the labor market Powell has been hoping for, but the headline numbers are good enough to push back on Trump’s call to cut rates below 2%. So now, the ball is back in inflation’s court. If July CPI comes in soft — and tariffs haven’t shown up in the numbers — the September cut is firmly in play

-

As Powell put it earlier this week: “If the labor market were to weaken meaningfully, it would be possible to cut sooner.”

-

Today didn’t force his hand — but that day is coming

Rates:

-

When does the market expect another next rate cut?

-

July: No

-

September: Maybe

-

October: If not September, then yes

-

December: Yes

-

SOURCE: BLOOMBERG

-

2-Year rates are 8-10 bps higher with 5,7,& 10-Year rates trading higher by smaller margins

-

The market seemed to be anticipating a miss today, so the reaction higher after the beat makes sense – just a smaller reaction than I would have expected

-

SOURCE: BLOOMBERG

-

Hedging activity still heavily favors the 2 and 3-Year part of the curve and we’re trading a bit higher following the dovish repricing of rate cuts today

-

Interesting to see the selloff fade into the afternoon though. Feels like we’re setting up for some sideways trading into the July 15th CPI report with markets generally comfortable leaving 2 rate cuts on the table for this year

|

SOFR Today: ~4.35% |

||

|

Vanilla Fixed Rate Swaps |

Rate |

Savings |

|

1-Year |

4.12% |

0.23% |

|

2-Year |

3.78% |

0.57% |

|

3-Year |

3.69% |

0.66% |

|

5-Year |

3.71% |

0.64% |

|

10-Year |

3.94% |

0.41% |

|

Vanilla Fixed Rate Swaps (w/ short cap) |

Rate |

Savings |

|

1-Year |

4.07% |

0.28% |

|

2-Year |

3.70% |

0.65% |

|

3-Year |

3.54% |

0.81% |

|

5-Year |

3.42% |

0.93% |

|

10-Year |

3.40% |

0.95% |

Rhetorical Question of the Day:

-

More or less something that’s been in the back of my mind lately: If Powell’s replacement gets the job based on a commitment to cut rates, when does that start to get priced in? Today, the bottom of the SOFR forward curve sits just north of 3%, but Trump has been calling for cuts below 2% - I wonder who will win?

SOURCE: BLOOMBERG

This material should be construed as the solicitation of an account, order, and/or services and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers.

The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. (“SGI”) disclaims any responsibility to update such views. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

References to certain OTC products or swaps are made on behalf of StoneX Markets, LLC (SXM), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (CFTC) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ and who have been accepted as customers of SXM.

StoneX Financial Inc. (SFI) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (SEC) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to certain securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to certain exchange-traded futures and options are made on behalf of the FCM Division of SFI. Wealth Management is offered through SA Stone Wealth Management Inc., member FINRA/SIPC, and SA Stone Investment Advisors Inc., an SEC-registered investment advisor, both wholly owned subsidiaries of SGI.

StoneX Financial Ltd (SFL) is registered in England and Wales, company no. 5616586. SFL is authorised and regulated by the Financial Conduct Authority (FCA) (registration number FRN:446717) to provide services to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised and regulated by the FCA under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the FCA.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.

StoneX Financial Pte Ltd (Co. Reg. No 201130598R) (“SFP”) is regulated by the Monetary Authority of Singapore and is a Capital Markets Service Licensee (for dealing in capital market products), an Exempt Financial Adviser (for advising on investment products and issuing or promulgating analyses/ reports on investment products) and a Major Payment Institution (for cross-border money transfer service).

SFP may distribute analysis/report produced by its respective foreign affiliates within the StoneX Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations Recipients should contact SFP at (65) 6309 1000 for any matters arising from, or in connection with, this webinar.

StoneX Financial (HK) Limited (CE)No.: BCQ152) (“SHK”) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

StoneX Securities Co., Ltd. (“SSJ”)(Co. Reg. No 010401047199) is regulated by the Japanese Financial Services Agency as a Type-I Financial Instruments Business Operator (Kanto Local Finance Bureau (FIBO)No.291’), is a member of the Financial Futures Association of Japan for dealing and broking FX and FX Option transactions, and is a member of the Japan Securities Dealers Association for dealing and broking stock indices and option transactions.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

The report/analysis herein is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

© 2025 StoneX Group Inc. All Rights Reserved.