| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 4.33% | 4.29% | 3.95% | 4.04% | 4.25% | 4.48% | |

Summary:

-

Headline CPI rose 0.3% in June, matching expectations, but marks the fastest pace since January

-

Core CPI rose 0.2%, slightly cooler than expected and the 5th straight downside surprise

-

Annual inflation now sits at 2.7% (headline) and 2.9% (core) — moving sideways, not downward

-

The rate market is backing away from expecting a rate cut anytime soon. The odds of a September cut are down to just 60% and only 4 cuts in total are reflected in swap rates

-

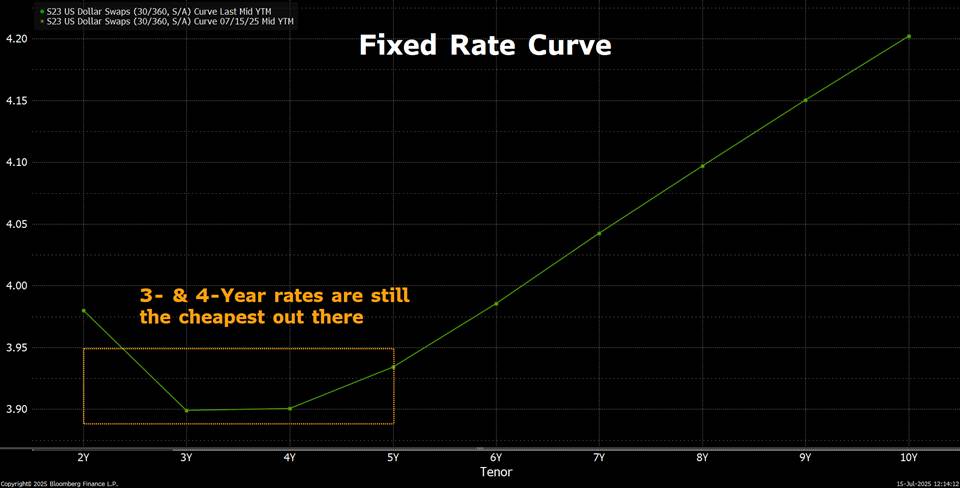

Borrowers continue to favor 3-Year hedging strategies, saving 0.60%-0.70% vs. doing nothing and paying floating rate SOFR

SOURCE: BLOOMBERG

Where tariff-driven inflation is showing up

We’re finally seeing signs that tariffs are working their way into CPI — but it’s still early, and the story isn’t uniform

-

Video and Audio Equipment: up 1.1%

-

Think TVs, speakers, headphones, smart home gadgets, etc. — most of it comes from China, and this kind of jump is too large to be explained away by seasonal noise. It’s early-stage pass-through, showing up exactly where you’d expect.

-

-

Appliances: up 1.9%

-

Another repeat offender. This is the third straight monthly increase for appliances — refrigerators, washers, dryers — all of which rely heavily on imported steel, chips, and plastic components

-

-

Apparel (overall): up 0.4%

-

This one flipped. After months of markdown-driven deflation, apparel posted a meaningful gain in June. Summer clearance discounts may have come in lighter, or early tariff costs are finally reaching the price tag. Either way, it's a notable shift

-

-

Housekeeping Supplies: up 0.8%

-

Another slow-burn category. Cleaning products, paper goods, and packaging-heavy items are starting to creep up — quietly reflecting rising base material and logistics costs

-

Where tariff-driven inflation is not showing up

In tariff-sensitive categories, prices are falling or rising less than you'd expect — likely a mix of soft demand, too much inventory, or retailers still eating the costs

-

New and Used Vehicles: down 0.4% & 1.5% respectively

-

New car prices are sliding — which is surprising given the tariff backdrop. But high financing costs and cautious buyers may be forcing dealers to discount anyway

-

Used cars aren’t tariff-exposed, but the bigger message here is about demand: it’s soft, especially for big-ticket purchases that require financing

-

-

Apparel (Overall): up 0.4%

-

Technically up — but only modestly, and men’s and women’s core categories remain mixed, with some outright falling

-

-

Furniture & Bedding: up 0.4%

-

A mild uptick in June, but still nowhere near tariff-typical behavior. Retailers may still be working through old stock

-

SOURCE: BLOOMBERG

Can the Fed cut in September?

They can… but they’ll need cover. Specifically, the next two CPI prints and job reports will need to deliver clean disinflation — and no surprises

-

It’ll take:

-

Two more core CPI prints at or below 0.2%

-

No tariff-driven inflation surprise in autos, apparel, or electronics

-

A labor market that continues to soften quietly, not collapse

-

-

After today, and depending on how the above unfolds, it’s more likely than not the Fed will kick the can down the road in September too

-

Goods inflation is the big shift

-

After over a year of deflation, tariff-exposed categories are now rising

-

Omair Sharif of ‘Inflation Insights’ flagged that when you exclude the disinflation within new and used cars, goods inflation really rose 0.55% - the highest since 2021

-

-

Then there’s the politics

-

Trump’s public call for 300bps of cuts adds an entirely different kind of pressure

-

I don’t think it won’t move Powell — but it raises the stakes around timing and optics

-

Any cut from now risks being seen as political, and that alone raises the bar for action

-

The Fed will demand a higher standard of proof, especially if they want to maintain independence

-

SOURCE: BLOOMBERG

What does this mean for borrowers?

-

If you’re managing floating rate debt (like operating lines), you don’t have to pay ~4.35% SOFR unless you want to. The fixed rate market is offering savings

-

A few things to think about (more on this in the attached):

-

Hedge half of your balance to 1) keep dry powder intact and 2) take a neutral interest rate stance

-

3-Year fixed rates give you flexibility down the road, while picking up the most savings today

-

Consider covered-call swaps to increase the savings while lowering margin costs at the same time

-

The Fed isn’t in a hurry, so each month they delay cuts, your fixed rate is saving you money

SOURCE: BLOOMBERG

This material should be construed as the solicitation of an account, order, and/or services and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers.

The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. (“SGI”) disclaims any responsibility to update such views. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

References to certain OTC products or swaps are made on behalf of StoneX Markets, LLC (SXM), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (CFTC) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ and who have been accepted as customers of SXM.

StoneX Financial Inc. (SFI) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (SEC) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to certain securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to certain exchange-traded futures and options are made on behalf of the FCM Division of SFI. Wealth Management is offered through SA Stone Wealth Management Inc., member FINRA/SIPC, and SA Stone Investment Advisors Inc., an SEC-registered investment advisor, both wholly owned subsidiaries of SGI.

StoneX Financial Ltd (SFL) is registered in England and Wales, company no. 5616586. SFL is authorised and regulated by the Financial Conduct Authority (FCA) (registration number FRN:446717) to provide services to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised and regulated by the FCA under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the FCA.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.

StoneX Financial Pte Ltd (Co. Reg. No 201130598R) (“SFP”) is regulated by the Monetary Authority of Singapore and is a Capital Markets Service Licensee (for dealing in capital market products), an Exempt Financial Adviser (for advising on investment products and issuing or promulgating analyses/ reports on investment products) and a Major Payment Institution (for cross-border money transfer service).

SFP may distribute analysis/report produced by its respective foreign affiliates within the StoneX Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations Recipients should contact SFP at (65) 6309 1000 for any matters arising from, or in connection with, this webinar.

StoneX Financial (HK) Limited (CE)No.: BCQ152) (“SHK”) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

StoneX Securities Co., Ltd. (“SSJ”)(Co. Reg. No 010401047199) is regulated by the Japanese Financial Services Agency as a Type-I Financial Instruments Business Operator (Kanto Local Finance Bureau (FIBO)No.291’), is a member of the Financial Futures Association of Japan for dealing and broking FX and FX Option transactions, and is a member of the Japan Securities Dealers Association for dealing and broking stock indices and option transactions.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

The report/analysis herein is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

© 2025 StoneX Group Inc. All Rights Reserved.