Dollar should reflect economic data in Brazil and the US

- Bullish

- Bearish

- Inflation, retail, and industry data in the US are expected to reinforce fears of the country’s “stagflation” and increase bets on interest rate cuts by the Federal Reserve, which undermines the attraction of foreign investment to the US and tends to weaken the dollar.

- Inflation, retail, and services data in Brazil are expected to reinforce the expectation that the basic interest rate (Selic) will remain higher for longer, favoring the attraction of foreign investment to Brazil and strengthening the real.

The week in review

- A new American “tariff shock” has come into effect, increasing concerns that import tariffs may result in “stagflation” in the economy (that is, a slowdown in growth and a pick up in inflation).

- The White House nominated Stephen Miran for the final months of Adriana Kugler's term, who resigned as a member of the Federal Reserve Board of Governors.

- Minutes from the Monetary Policy Committee (Copom) decision reinforced the Central Bank of Brazil's cautious stance by advocating for keeping the benchmark interest rate (Selic) high for a “considerably prolonged” period.

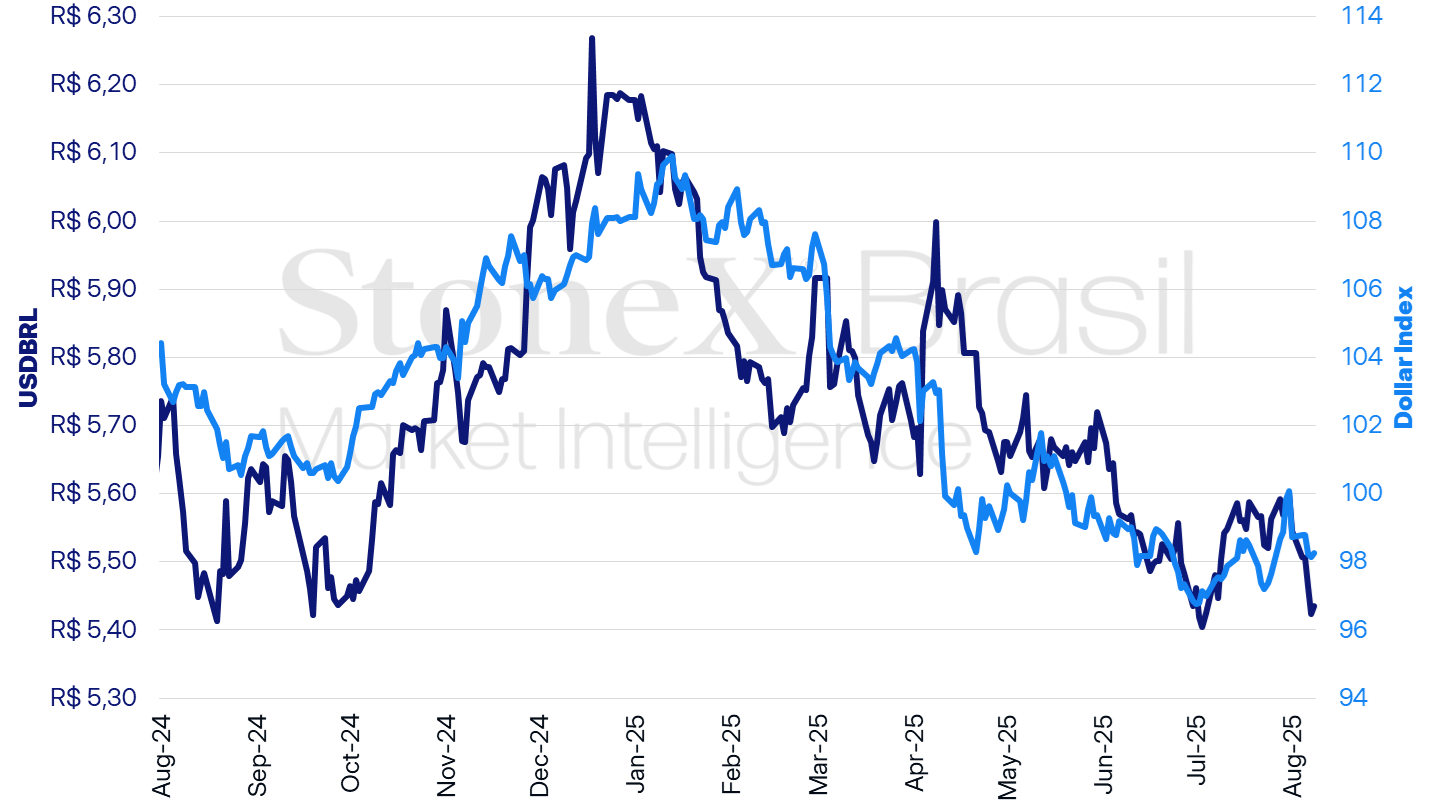

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

Variations of the USDBRL | Daily: +0.22% | Weekly: -1.99% | Monthly: -2.97% | YTD: -12.03% | In 12 months: -2.50% |

Dollar index variations | Daily: +0.14% | Weekly: -0.47% | Monthly: -1.80% | YTD: -9.12% | In 12 months: -4.79% |

KEY EVENT: Fears of "stagflation" in the United States

Expected impact on USDBRL: bearish

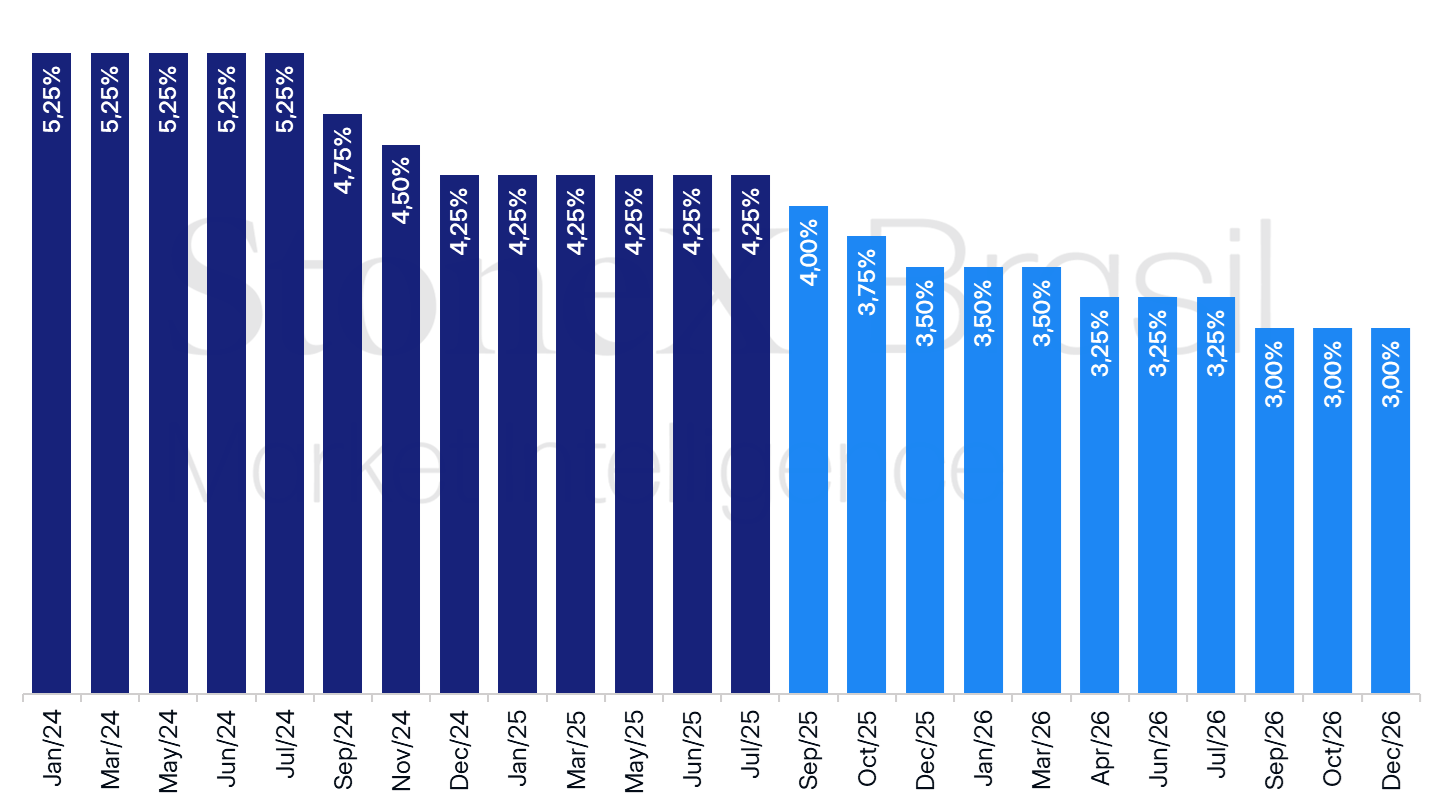

USA: History and expectation for the interest rate – updated on August 8, 2025

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Investors are more concerned about the risks of “stagflation” in the United States, that is, a slowdown in economic growth simultaneously with an increase in inflation.

- This, in turn, increases investors' bets for faster rate cuts by the Federal Reserve.

Why this is important: The prospect of lower interest rates in the US reduces the expected returns on the country's bonds, making it harder to attract foreign investment and contributing to a weakening of the dollar.

- Additionally, the prospect of lagging growth in the American economy also reduces the expected profitability of productive investment in the country, which makes it harder to attract foreign investment and contributes to weakening the dollar.

Limited effects until July: Until the end of July, investors were optimistic about the economic conditions in the United States due to the very subtle impacts of import tariff on macroeconomic variables.

- Consider, for example, that Federal Reserve Chairman Jerome Powell stated on July 30 that "we have risks to both of our goals [price stability and maximum employment], and [inflation] is further from the target than [employment]."

- These subtle impacts were likely the result of two simultaneous movements.

- First, companies brought forward their imports in the first quarter to build up stocks before the tariffs came into effect in April, which prevented the immediate pass-through of higher import costs.

- In addition, consumers anticipated purchases of some product categories in the first quarter due to fears of higher prices after April, which led to a temporary strengthening of demand.

Fears after August: This optimism quickly faded after the release of the July Employment Situation report on August 1, which showed both weaker-than-expected net job creation for the month and drastically revised downward the figures for May and June.

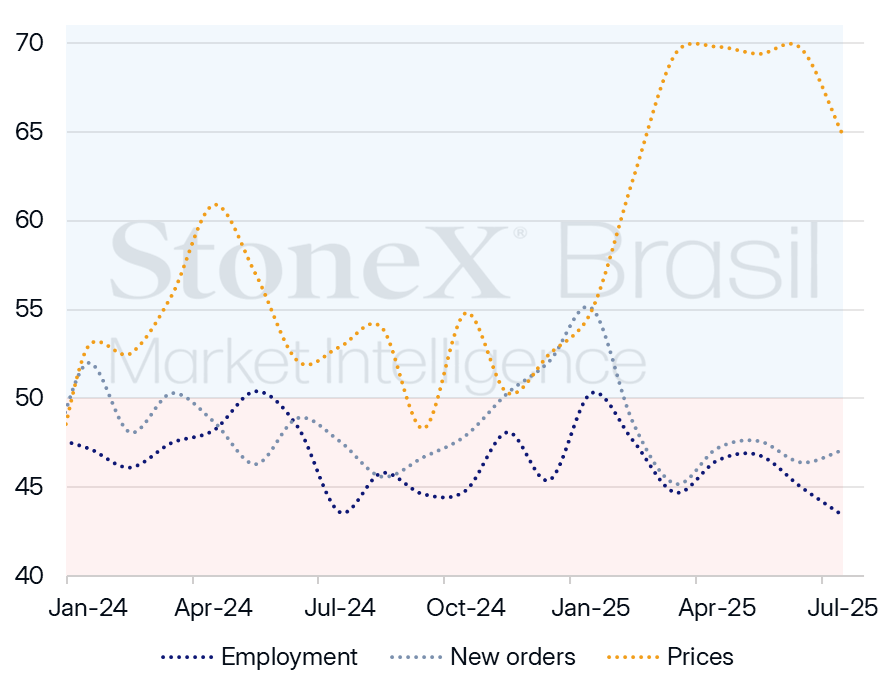

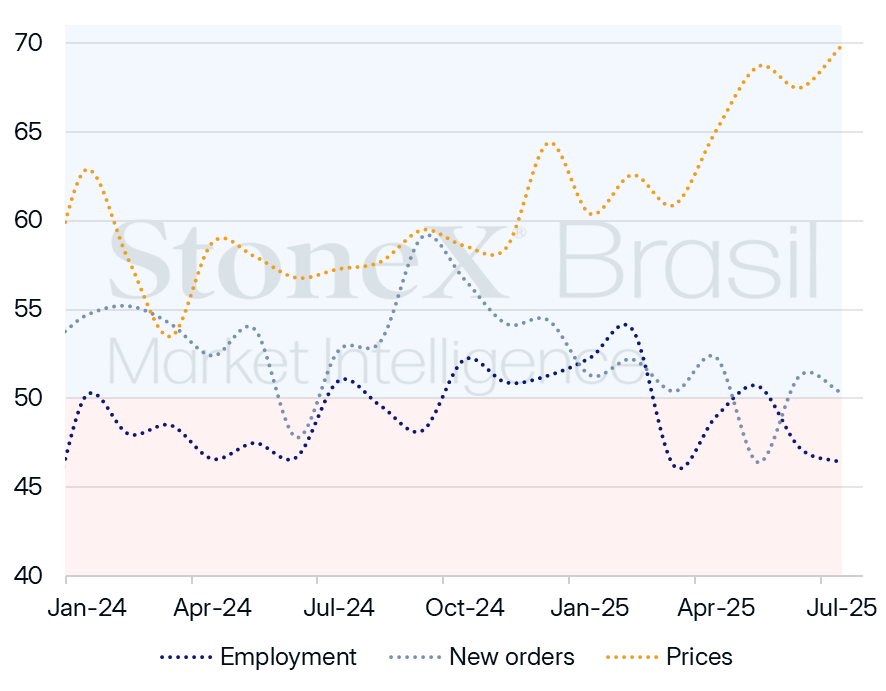

- Additionally, the United States Purchasing Managers' Indexes (PMI) also indicated a slowdown in production and employment and inflationary pressures in July, reinforcing the country's fears of “stagflation.”

PMI for the United States industry (left) and services (right) and selected subcomponents

Source: Institute for Supply Management (ISM). Design: StoneX.

Source: Institute for Supply Management (ISM). Design: StoneX.

"No hire, no fire": However, it is necessary to consider that migratory flows have drastically decreased throughout 2025, which reduces the size of the country's workforce. Therefore, slower job creation would not necessarily result in a higher unemployment rate.

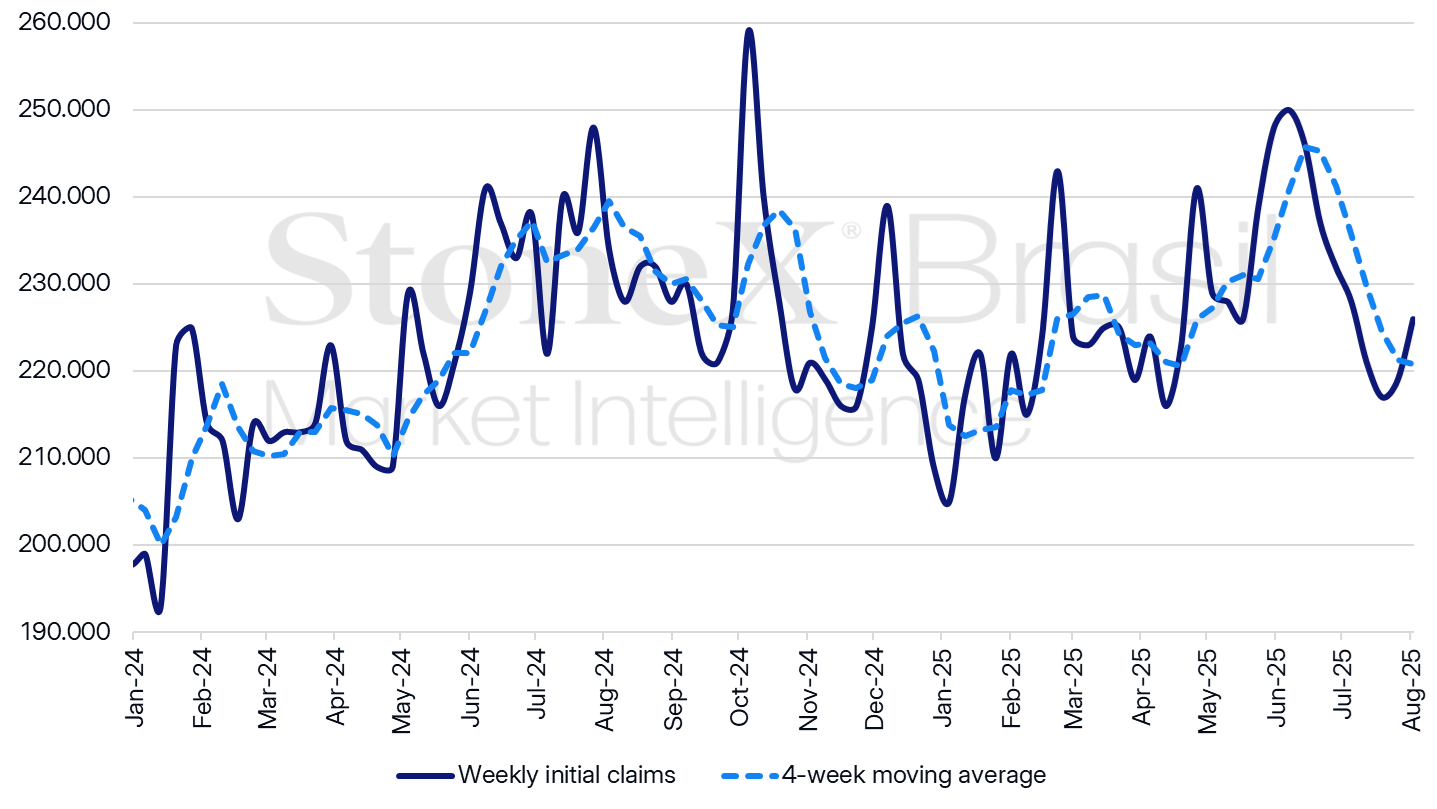

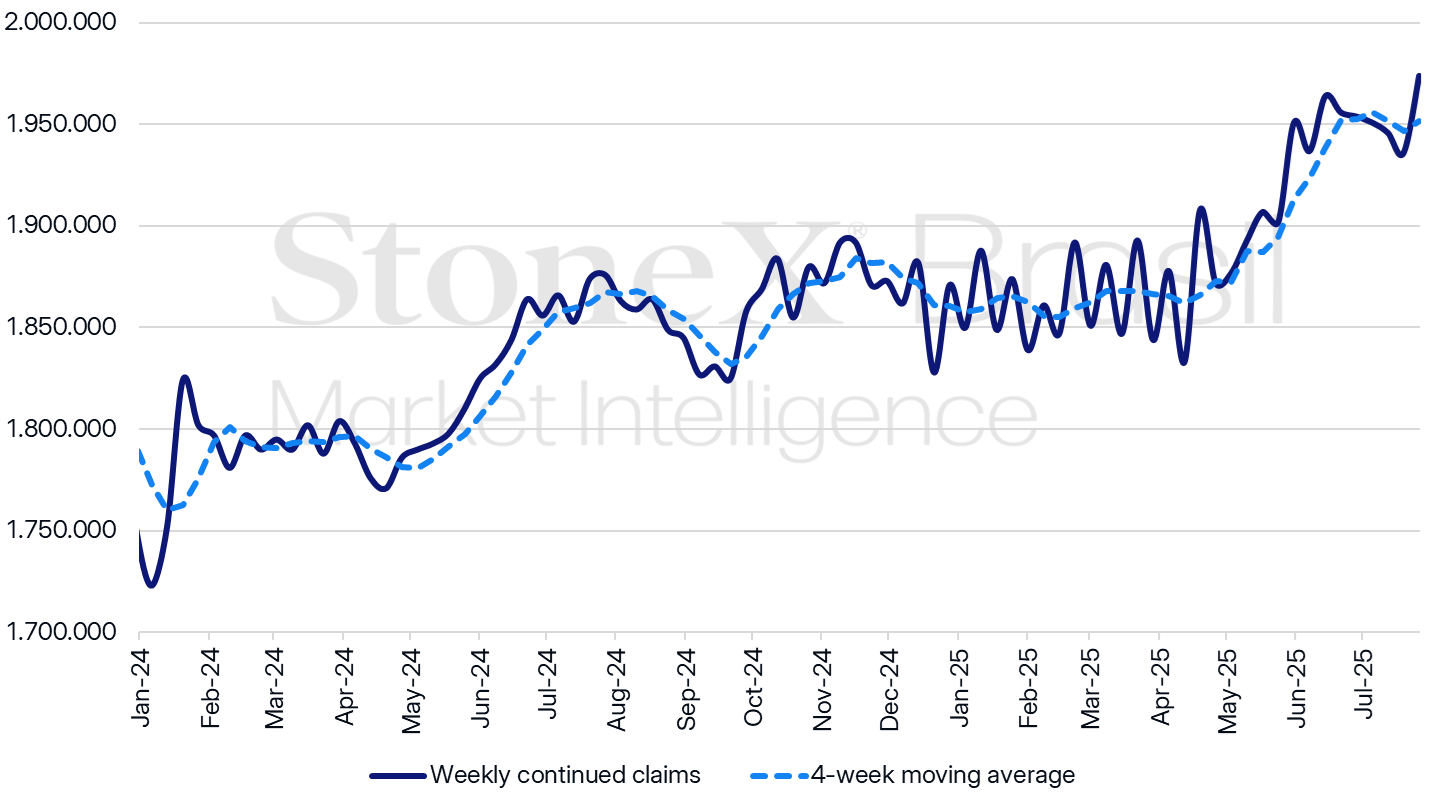

- In the same vein, the weekly unemployment assistance data imply that there is no pick up in the number of new claims, which imply that the pace of layoffs is approximately stable.

- Meanwhile, continued jobless claims, that is, the number of people who keep receiving the benefit after the first week, show a rapid pick up, which imply that the pace of hiring has decreased significantly.

- This scenario can be called "no hire, no fire", that is, no hiring or firing, an indication that the labor market is weakening, but it is not in crisis.

New weekly claims (left) and weekly continuing claims (right) for unemployment benefits in the United States

Source: U.S. Department of Labor (DOL), Federal Reserve Bank of St. Louis. Design: StoneX.

Source: U.S. Department of Labor (DOL), Federal Reserve Bank of St. Louis. Design: StoneX.

New data in the week: This week, new important indicators will be released for investors to assess whether import tariffs are indeed harming the American economy.

- The consumer price index (CPI), which will be released Tuesday (12), is expected to show that tariffs continue to put pressure on inflation in segments more exposed to international trade, with a pick up in industrial goods prices and a slowdown in service prices.

- As an aftermath, the median of the estimates indicates that the core of the indicator, which excludes the volatile food and energy components, should accelerate from 0.2% in June to 0.3% in July.

- On Friday (15), U.S. retail sales are expected to show slower growth in July, while manufacturing is expected to contract in the same month.

In summary: The data for the US economy should reinforce investors' concern about the possibility of a "stagflation" in the country, which tends to increase bets on interest rate cuts by the Federal Reserve and weaken the dollar globally.

Economic data from Brazil

Expected impact on USDBRL: bearish

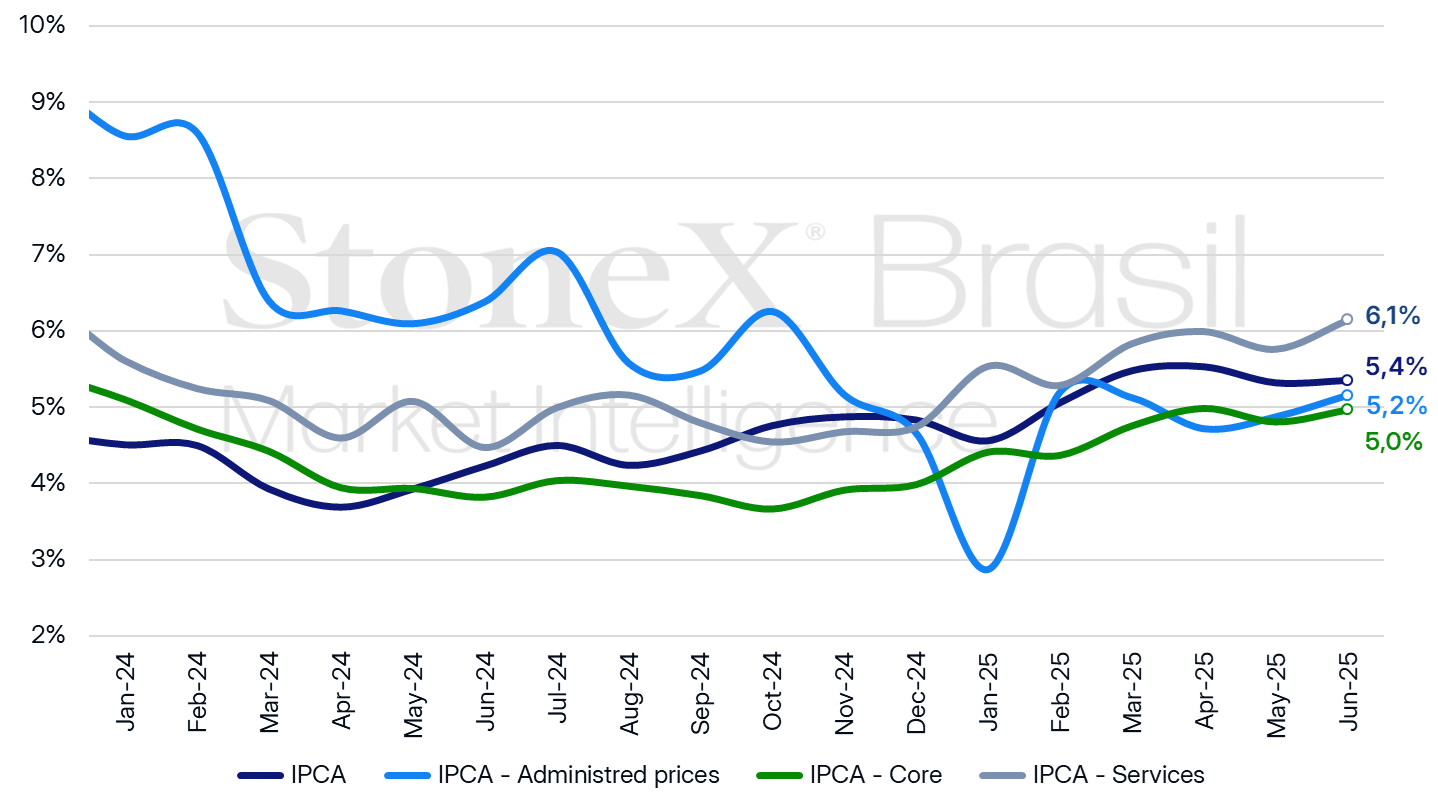

12-month IPCA according to selected groups (%)

Source: Central Bank of Brazil. Design: StoneX.

In Brazil, investors should pay attention to the release of the Broad National Consumer Price Index (IPCA) for July, as well as the monthly survey of services and the monthly survey of trade for June.

Why this is important: Both the release of the IPCA and the economic activity data throughout the week may influence expectations regarding the trajectory of Brazilian interest rates.

- If the expected pick up in inflation and the continued resilience of domestic activity are confirmed, the scenario tends to reinforce the expectation of elevated levels for the basic interest rate (Selic) for a longer period.

- Such a perspective, in turn, encourages the attraction of foreign investment and contributes to the performance of the real.

What to expect? The median of the projections for the IPCA in July points to a pick up in inflation, from 0.24% in June to 0.34% in July.

- If confirmed, this result would keep the accumulated inflation over 12 months at 5.33%, above the ceiling of the target of 4.50% per year established by the Central Bank.

- The rise in inflation should be associated especially with higher electricity prices and a likely increase in airfares.

- At the same time, the service and trade surveys should continue to show resilience, in line with recent activity data, such as the GDP for the first quarter of 2025 and the latest indicators for the labor market.

Overview: As highlighted in the minutes of the last Monetary Policy Committee (Copom) meeting, this week’s data will be observed amid the context in which the Central Bank continues to assess “the accumulated impacts of the monetary adjustment already carried out, still to be observed, (...) [and whether they are] sufficient to ensure inflation converges to the target.”

- Given the expectation of inflation still above the target ceiling and the maintenance of a robust level of economic activity, the indicators should reinforce the stance of caution adopted by the Central Bank, keeping the basic interest rate (Selic) at a high level for a “rather prolonged period.”

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.