Dollar should reflect fears of stagflation in the US, new "tariff shock", Copom minutes and Brazilian contingency plan

- Bullish

- Bearish

- The implementation of higher import tariffs for the US increases concerns about the country’s “stagflation,” which makes it harder to attract foreign investment to the US and tends to devalue the dollar.

- Weaker data for the US labor market increase bets on interest rate cuts by the Federal Reserve, which harms the attraction of foreign investment to the US and tends to depreciate the dollar.

- The minutes of the Monetary Policy Committee (Copom) decision should reinforce expectations of keeping the basic interest rate (Selic) higher for longer, favoring the attraction of foreign investment to Brazil and strengthening the real.

- “Contingency plan” to smooth the impacts of American tariffs on Brazil should be included within the existing Budget for the year, reducing the perception of fiscal risks for Brazilian assets and contributing to the strengthening of the real.

The week in review

- Data for the U.S. labor market surprise with much weaker results than anticipated, increasing fears of "stagflation"

- The White House increased the tariffs for import tariffs from 70 trading partners, effective starting this Thursday (07).

- Despite confirming the tariff of 50% on Brazilian products, the White House unexpectedly maintained reduced tariffs for almost 700 products.

- Federal Reserve kept its interest rate flat, citing risks of inflationary pressures as a result of higher tariffs.

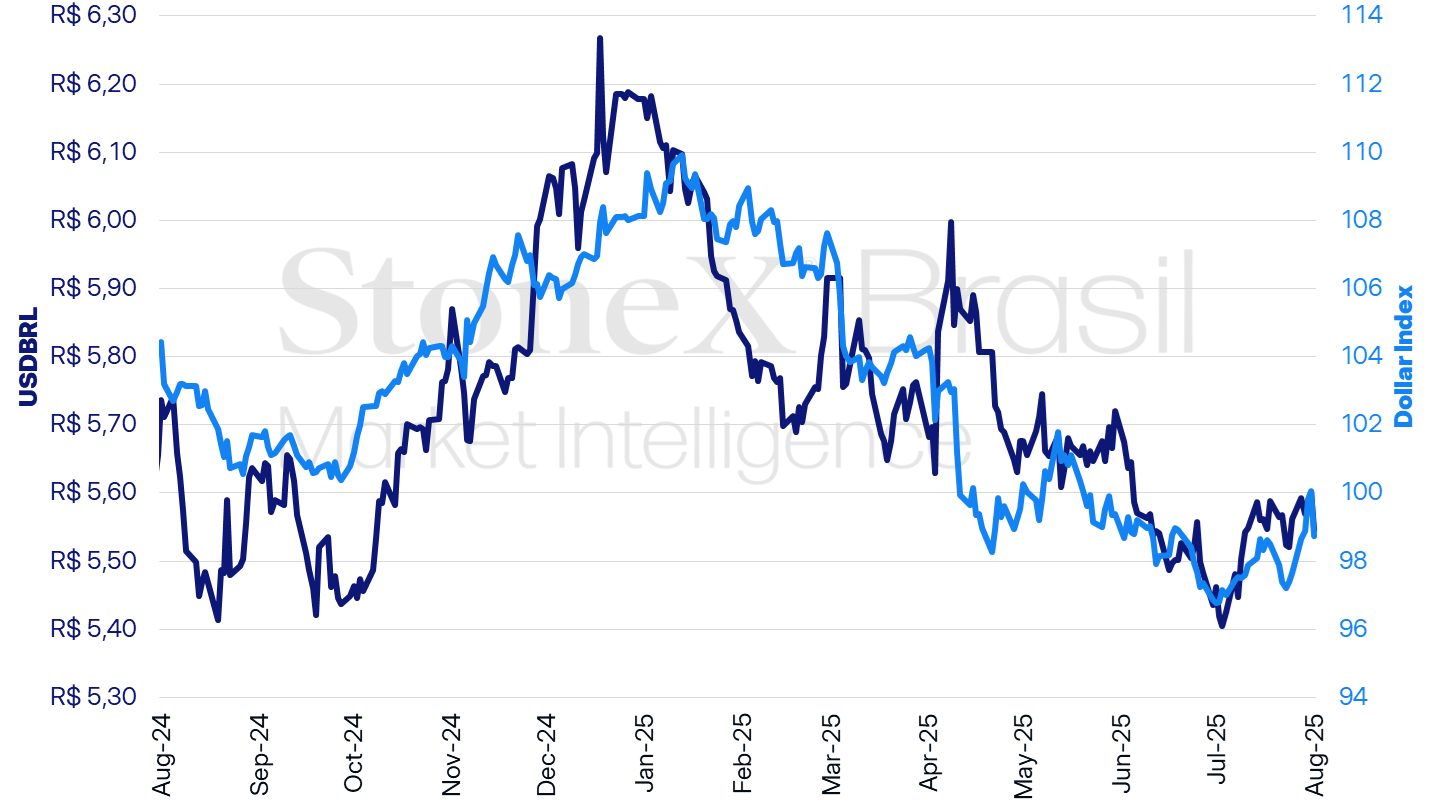

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

Variations of USDBRL | Dayly: -0.99% | Weekly: -0.31% | Monthly: -0.99% | YTD: -10.24% | In 12 months: -3.33% |

Dollar index variations | Daily: -1.34% | Weekly: +1.11% | Monthly: -1.34% | YTD: -8.69% | In 12 months: -5.45% |

MOST IMPORTANT: New American "tariff shock"

Expected impact on USDBRL: bearish

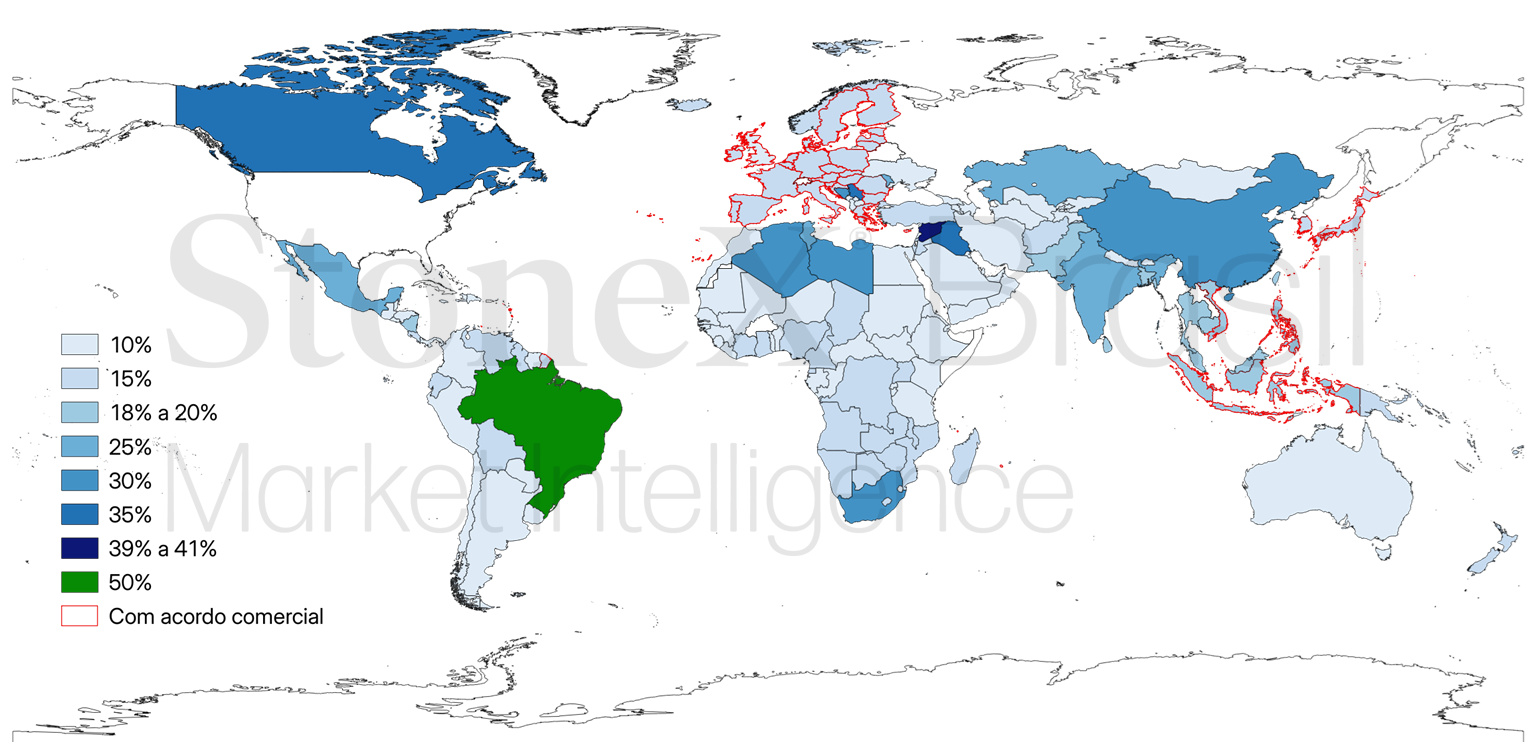

Import tariffs – tariffs announced on April 2 by the White House (left) and in July (right)

Source: White House. Design: StoneX.

Source: White House. Design: StoneX.

The White House has once again increased import tariffs for 70 trading partners starting this Thursday (07).

- The other economies will continue to be taxed at 10%.

- After months of inconsistencies, the United States signals that, this time, it will fulfill the threat to significantly increase its trade barriers.

Why this is important: The hardening of the US commercial stance increases fears among investors of a pick up in inflation and a slowdown in growth simultaneously.

- This, in turn, hampers the attraction of productive and financial investment to the United States, contributing to a global devaluation of the dollar.

- On the other hand, fears of stagflation in the US may result in greater global risk aversion and spur the search for assets considered “safe havens” during times of stress, which tends to depreciate the real.

Firm stance: The seriousness of the White House's intentions can also be seen in the trade agreements it has signed with other economies, maintaining high tariffs even after the agreements.

- For example, the tariff for Japan, South Korea, and the European Union will be 15%, 19% for the Philippines and Indonesia, and 20% for Vietnam.

Fears of "stagflation": Until last Friday (01), although there was almost consensus among analysts that the increase in tariffs would increase inflationary pressures and reduce economic growth, the available indicators showed little evidence of these effects.

- The Federal Reserve, for example, justified the decision to keep its interest rates stable last Wednesday (30) due to the risks that import tariffs may result in broader and more persistent inflationary pressures.

- This changed with the release of the July Employment Situation Report, which showed both a weaker-than-expected net job creation for the month and drastically revised downward the figures for May and June.

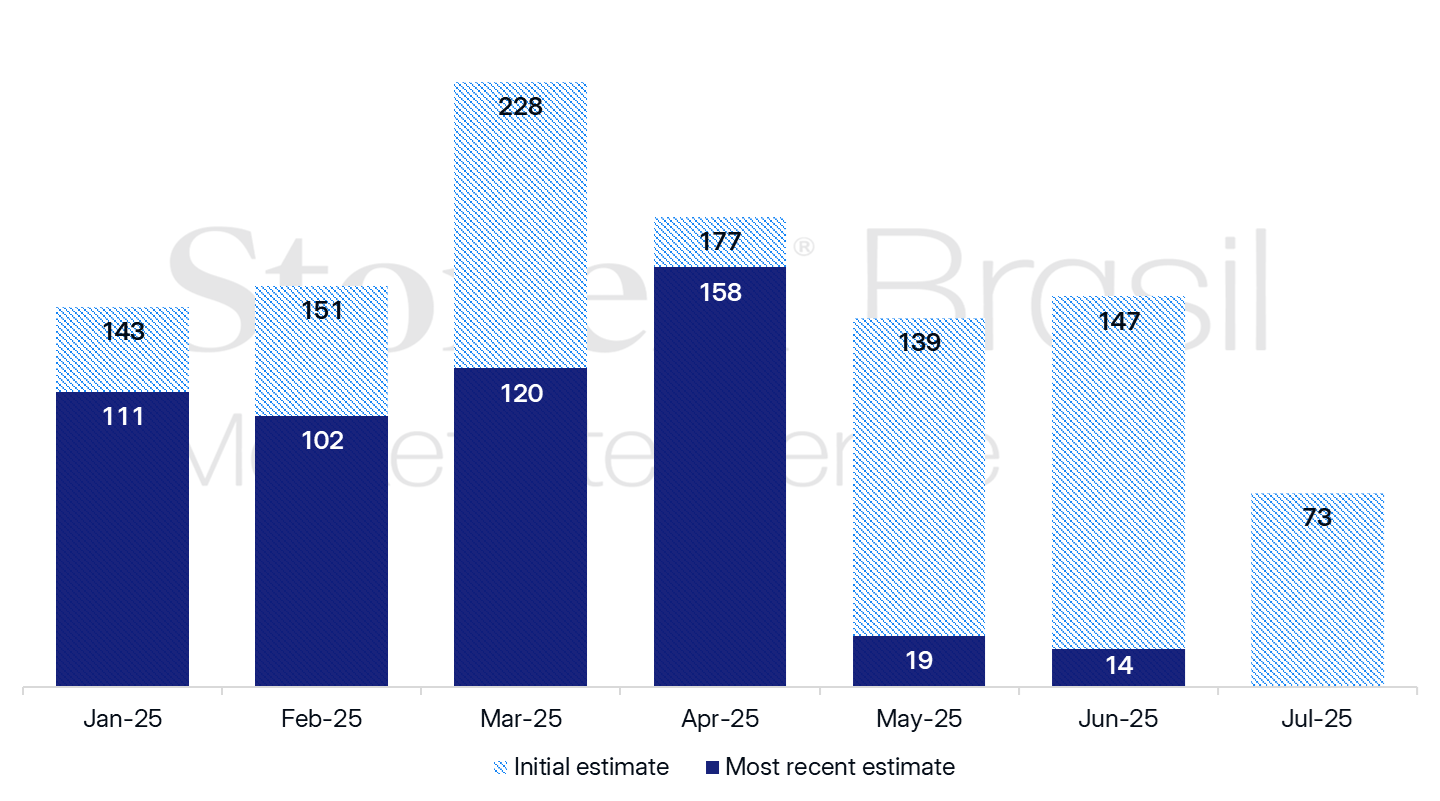

Revisions to nonfarm payroll estimates (thousand people)

Source: U.S. Bureau of Labor Statistics (BLS), Federal Reserve Bank of St. Louis. Design: StoneX.

Expectation of interest rate cuts: weak labor market data resulted in a rapid increase in investors' bets on interest rate cuts by the Federal Reserve in order to reduce their negative impacts on the American economy.

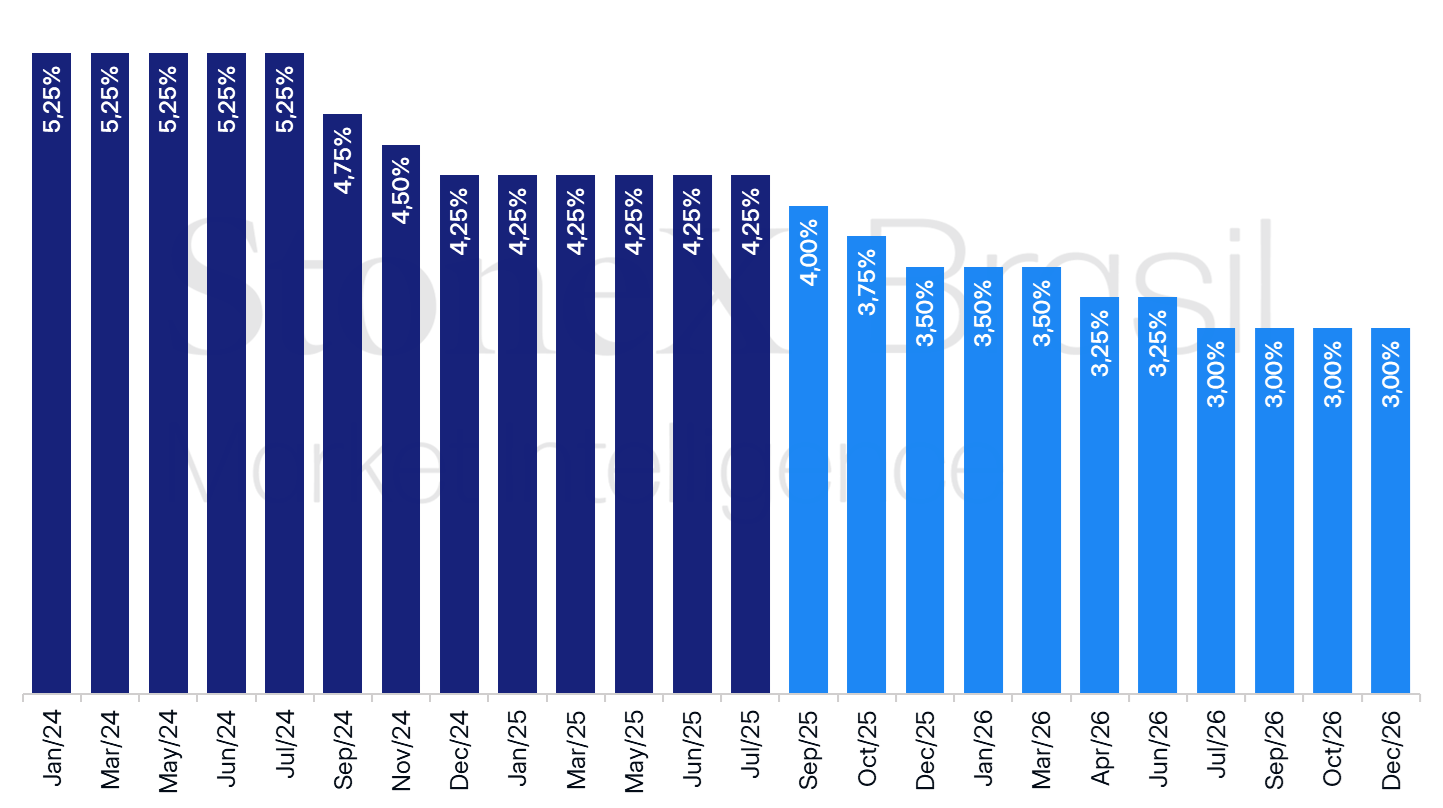

USA: History and expectation for the interest rate - updated on August 1, 2025

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Exemptions for Brazil: Of all the tariffs announced by the United States, the highest will be on Brazil's products, at 50%.

- However, the announcement was surprising by keeping the tariff at 10% for almost 700 Brazilian products, such as orange juice, iron ore, primary iron and steel products, fertilizers, cellulose, energy products, and civil aviation products.

- This reduction applies to almost half of Brazilian exports to the US, which should soften the negative impact of this taxation.

- Even so, some important segments will be tariffed, such as coffee, meats, fish, and fruits.

Copom Minutes

Expected impact on USDBRL: bearish

This Tuesday (05), the Central Bank (BC) releases the minutes of the Monetary Policy Committee (Copom) meeting from last Wednesday (30), in which Copom unanimously decided to keep the basic interest rate (Selic) at 15.00% per year.

- In the statement, the Committee indicated that interest rates should remain stable "for a very prolonged period," while assessing whether "the accumulated impacts of the adjustment already carried out (...) [are] sufficient to ensure the convergence of inflation to the target".

Why this is important: Keeping the Selic at a high level for a long period favors the outlook for the domestic interest rate differential compared to other economies, which favors the attraction of foreign capital and helps to strengthen the real.

Expectation: The minutes of the decision should deepen the Committee's analysis of the balance of inflationary risks and offer clues about the future path of monetary policy.

- On one hand, the document should reinforce the stance of caution in light of the unpredictability generated by the new American tariffs, especially regarding the potential effects on Brazilian economic growth.

- In addition, the Committee should reinforce its firm tone regarding inflationary stabilization. In this sense, the statement once again signaled the resilience of the labor market as a risk factor for inflationary stabilization in the country.

- In this context, it is worth adding that yesterday's release of the Continuous National Household Survey (Pnad Contínua) corroborated this view by showing a drop in the unemployment rate to 5.8% in the quarter ended in June, the lowest level in the historical series that began in 2012.

Federal government contingency plan

Expected impact on USDBRL: bearish

In Brazil, investors should remain attentive to the federal government's response to the 50% tariff made official by the United States on part of national exports, which will take effect next Wednesday (6).

- According to the Minister of Finance, Fernando Haddad, starting next week, the Executive should already signal the first measures to protect the national industry and agriculture

- Also according to Haddad, the proposed measures will not require spending outside the current fiscal framework, with the possible use of extraordinary credit, without compromising the primary result.

Why this is important: If the plan is well received and indeed does not imply additional risks to the fiscal scenario, the real may benefit from a reduction in risk perceptions regarding domestic assets.

Overview: According to the Minister of Development, Industry, Commerce and Services, Geraldo Alckmin, the new tariffs should apply to about 35.9% of Brazilian exports to the US, despite the exclusion of some important items such as energy, orange juice, and aircraft.

- For the affected companies, the plan should include revisions to export support programs, worker protection, and targeted support for agribusiness and industry companies.

- Haddad also pointed out that part of the affected companies will be able to redirect their production to the domestic market, reducing the need for additional support.

- The expectation for progress in bilateral negotiations with the United States will also be monitored, especially after Haddad indicated that he is waiting to schedule a meeting with US Treasury Secretary Scott Bessent, a figure considered strategic for the mediation of an eventual understanding.

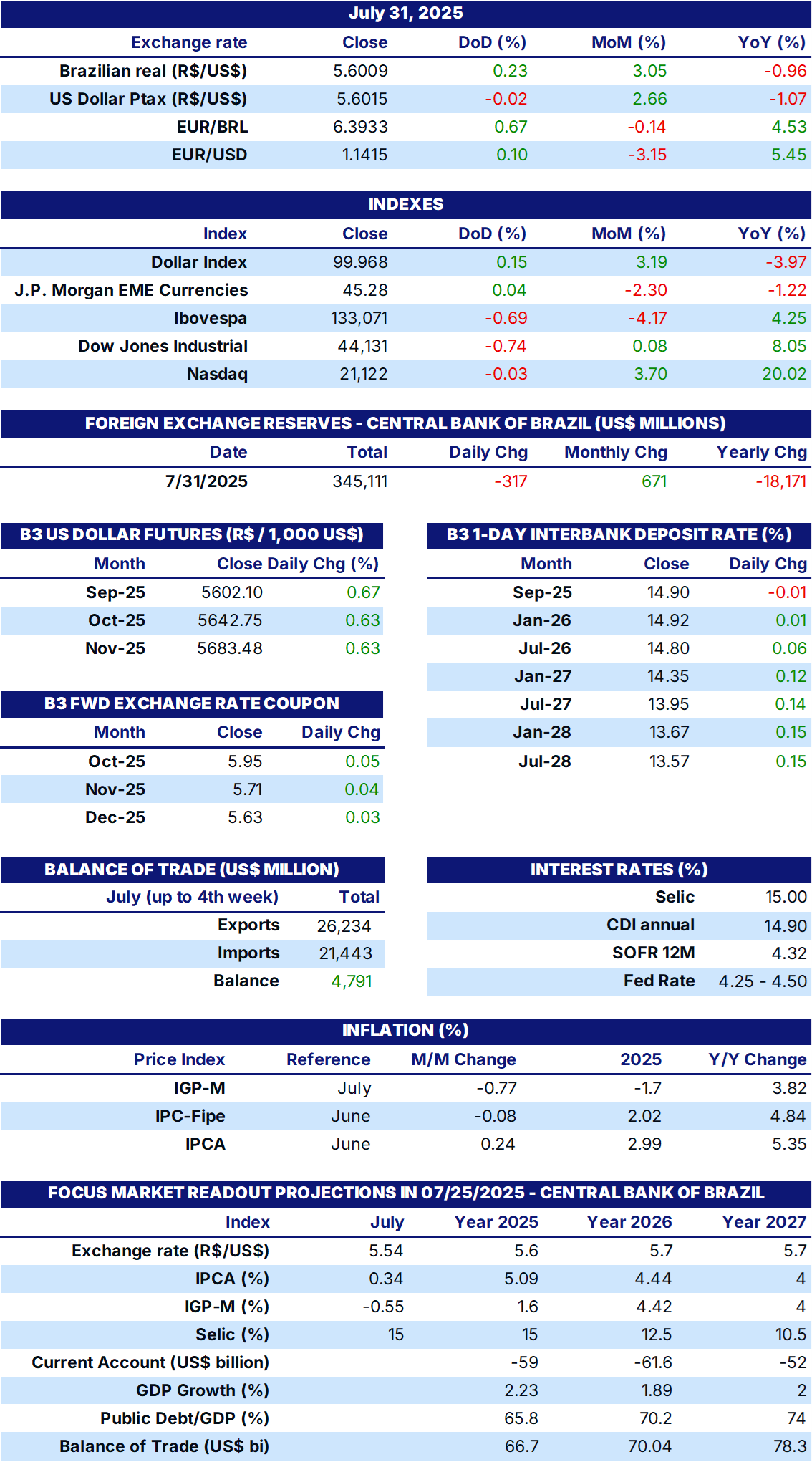

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.