- Bearish factors

- The Central Bank of Brazil's interest rate decision should reinforce expectations of keeping the basic interest rate (Selic) higher for longer, favoring the attraction of foreign investment to Brazil and strengthening the real.

- Bullish factors

- A tougher American commercial stance may lead to greater global risk aversion, which tends to depreciate the real.

- The threat of 50% US tariffs on Brazil may increase the perception of risks for Brazilian assets and harm the performance of the real.

- Federal Reserve interest rate decision should reduce bets on short-term rate cuts, which favors the attraction of financial investment to the US and tends to appreciate the dollar.

- Hot economic data for the US should reduce bets on interest rate cuts by the Federal Reserve, which favors attracting financial investment to the US and tends to appreciate the dollar.

The week in review

• The White House announced trade agreements with Japan, the Philippines, and Indonesia with tariffs of 20%, 19%, and 19% on the exports of these countries, respectively.

• Investors showed optimism about the possibility of an agreement with the European Union.

• Brazil tries to negotiate a consensus with the US, but finds little receptivity.

• European Central Bank kept its interest rate flat at 2.00% p.a.

• IPCA-15 accelerated more than expected in Brazil.

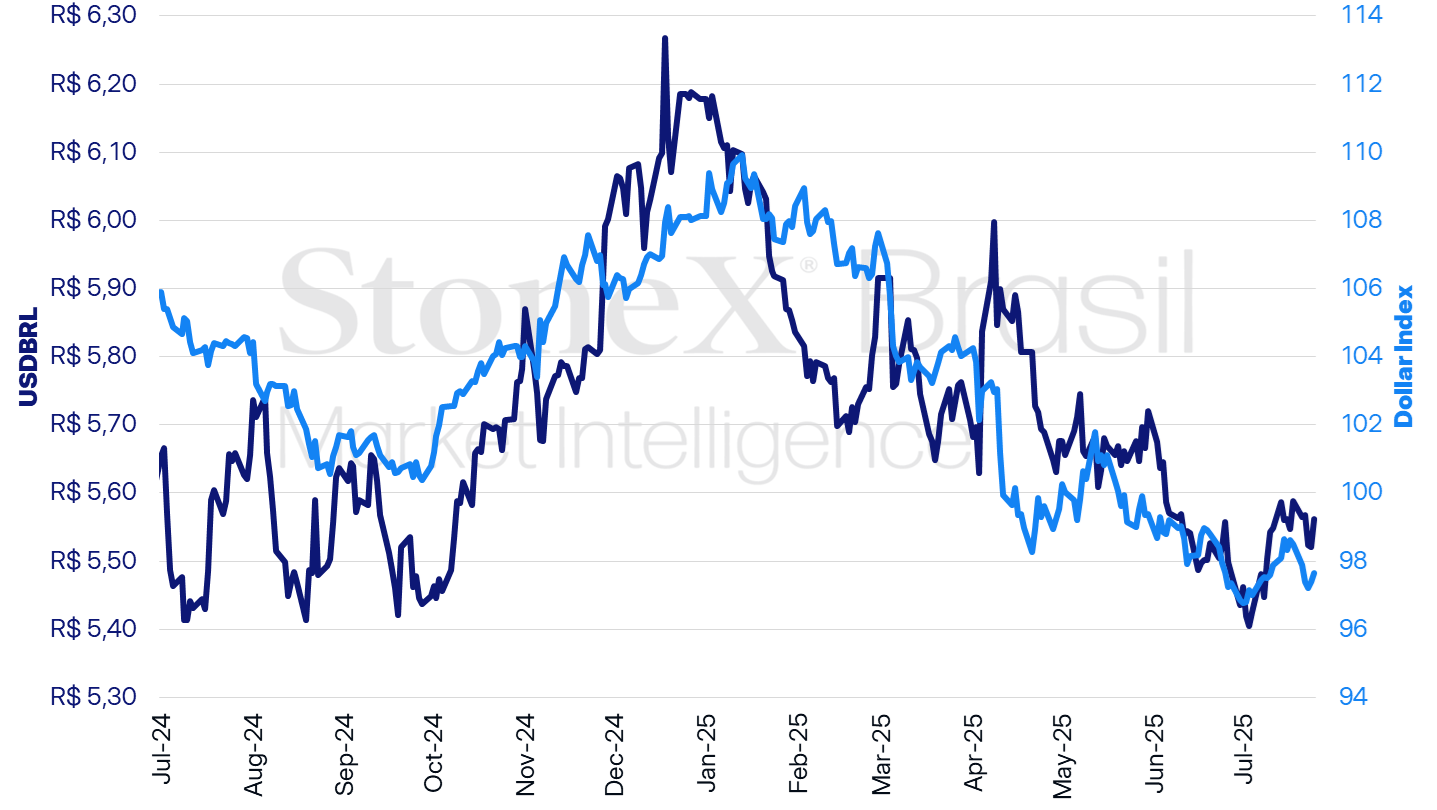

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

Variations of USDBRL | Dayly: +0.75% | Weekly: -0.46% | Monthly: +2.34% | YTD: -9.96% | In 12 months: -1.51% |

Dollar index variations | Daily: +0.28% | Weekly: -0.86% | Monthly: +0.82% | YDT: -9.69% | In 12 months: -6.43% |

KEY EVENT: End of the new deadline for the “truce” on American tariffs

Expected impact on USDBRL: bullish

The new deadline for the temporary reduction of most American import tariffs to a tariff of 10% ends this Thursday, July 31.

Why this is important: In theory, the tightening of the US commercial stance tends to fuel fears of a more intense slowdown in both the global and American economies, which, in turn, stimulates the search for assets considered “safe havens” in times of stress and tends to depreciate the real.

Toughening the threats: In theory, the tariffs on import tariffs should have returned to the values announced on April 2 last Thursday (10).

- However, Trump extended the deadline for a temporary reduction of almost all tariffs to 10% until the end of July and again announced new tariffs for a group of countries, without explaining how the new values were determined.

- The American president has insisted that there will be no new extension of the temporary tariff reduction period, and warned that he will increase the tariffs of countries that impose tariffs on American products as retaliation.

- Additionally, the American president announced a 50% import tariff on copper, also starting from August 1.

New agreements are a concern: So far, the White House has reached more formal trade agreements with the United Kingdom, Vietnam, Japan, the Philippines, and Indonesia, in addition to a “consensus” with China to maintain bilateral trade during the 90-day truce.

- However, in these agreements, the countries agreed to heavy tariffs on most of their products: 10% for the United Kingdom, 15% for Japan, 19% for the Philippines and Indonesia, and 20% for Vietnam.

- This shows that the White House really intends to heavily increase its trade barriers, which raises concerns about “stagflation” in the United States, that is, a slowdown in growth along with an increase in inflationary pressures.

- Additionally, the White House announced the new tariffs for only 25 economies. For the more than 150 countries that remain, Trump stated that he will send a single letter defining this tariff this week.

- “We'll have a straight, simple tariff of anywhere between 15% and 50%,” he said.

- Most analysts believe that American tariffs will rise substantially in this second half of the year.

Optimism about trade agreements: Despite these indications that the US will follow through on its threat and toughen its trade stance, financial markets have shown rather contained fluctuations, suggesting that investors remain optimistic even in the face of these threats.

- Perhaps investors still believe that the president of the United States is bluffing, using the threat of higher tariffs as a negotiating tool to pressure other countries into making trade deals.

- Another possibility would be optimism that the White House will reach new trade agreements with other nations, resulting in tariffs lower than anticipated.

- This week, it was speculated that both the European Union and India were close to reaching an agreement with the US.

Pessimism in Brazil: Of all the tariffs promised for August 1, the highest was Brazil's, at 50% on its products.

- There is a perception that the White House wants to punish Brazil in an exemplary way because of its dissatisfaction with the judicial proceedings against former President Jair Bolsonaro.

- This perception is reinforced by the lack of responses from the American government to the Brazilian government's attempts at trading.

- The President of Brazil, Luiz Inácio Lula da Silva, has shown that he intends to match any unilateral increase in tariffs based on the Economic Reciprocity Law.

- At the same time, the Minister of Finance, Fernando Haddad, said that the government is preparing a contingency plan “with proposals of all kinds” to soften the impacts from the application of these tariffs.

- Even so, the implementation of a tariff of this magnitude could seriously harm the economy and Brazilian exports, which could result in a devaluation of the real.

FOMC interest rate decision

Expected impact on USDBRL: bullish

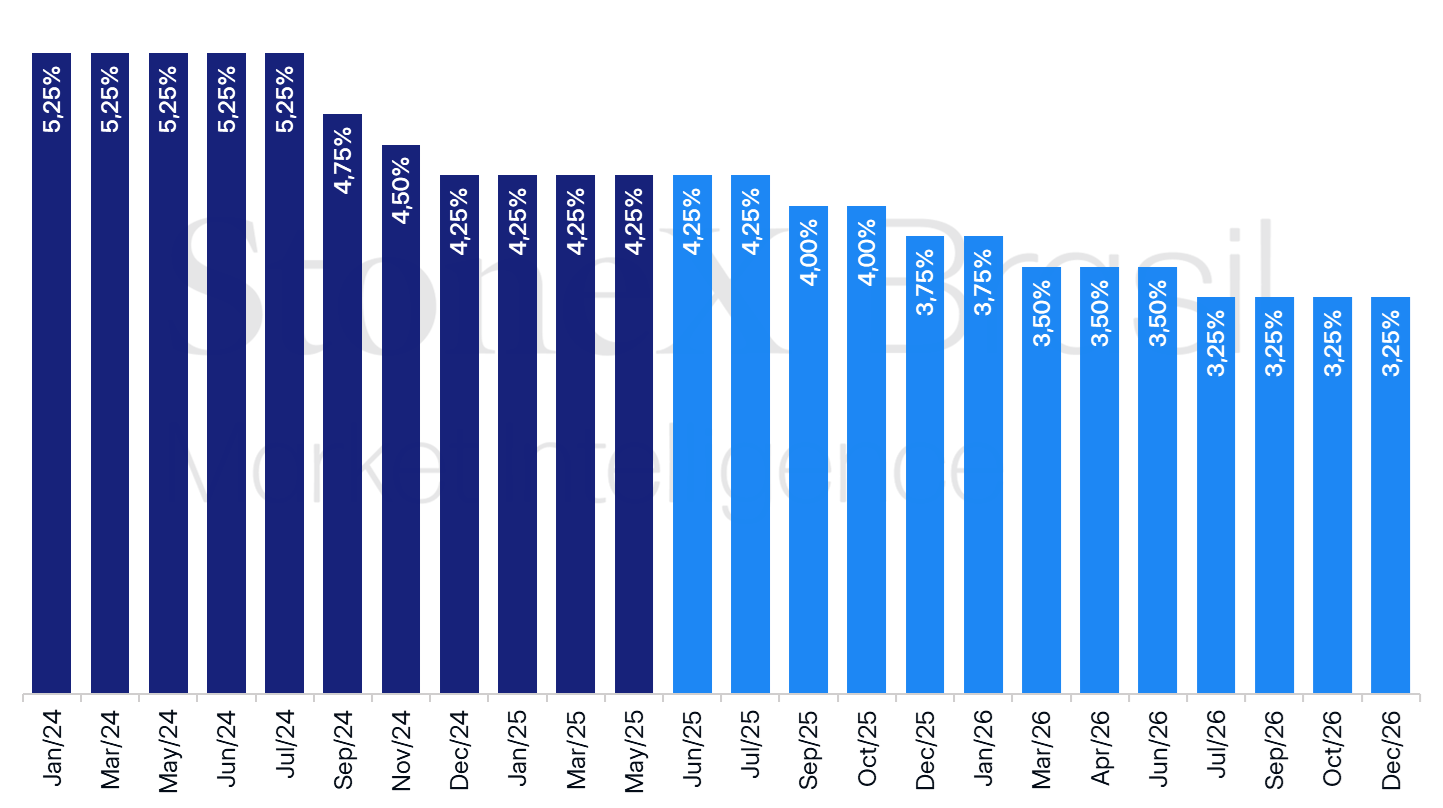

USA: History and expectation for the interest rate - updated on July 25, 2025

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Fed's Federal Open Market Committee (FOMC) is expected to keep its interest rate unchanged in its decision this Wednesday (30), in the range between 4.25% and 4.50% per year.

Why this is important: Both the decision statement and the press conference by Jerome Powell, chairman of the Fed, should signal that the FOMC is in no hurry to cut interest rates, reducing bets on new cuts among investors and strengthening the dollar globally.

Overview: After reducing interest rates by 1.00 p.p. in 2024, the Federal Reserve has adopted a cautious stance and kept interest rates stable in 2025 due to the intense pace of government changes in areas such as foreign trade, immigration, fiscal policy, energy policy, business regulation, federal administration structure, and diplomacy, with important doubts about the possible impacts of these policies.

- In particular, the FOMC believes that the sharp increase in import tariffs should result in inflationary pressures on the economy, and that it is prudent to wait for the evolution of the data before resuming interest rate cuts.

- The Consumer Price Index (CPI) for June reinforced this concern by showing the first identifiable effects of tariffs on the prices of some sectors more exposed to international trade, such as electronics, clothing, footwear, and furniture.

- In this sense, the Committee should have greater clarity until its September decision, being able to observe the inflation data for July and August until then.

Other inflationary risks: In addition to the risk of tariff impacts, two other factors may result in higher inflationary pressures in the second half.

- First of all, the depreciation of the American currency in the first half of the year also tends to increase the import costs for the country's companies.

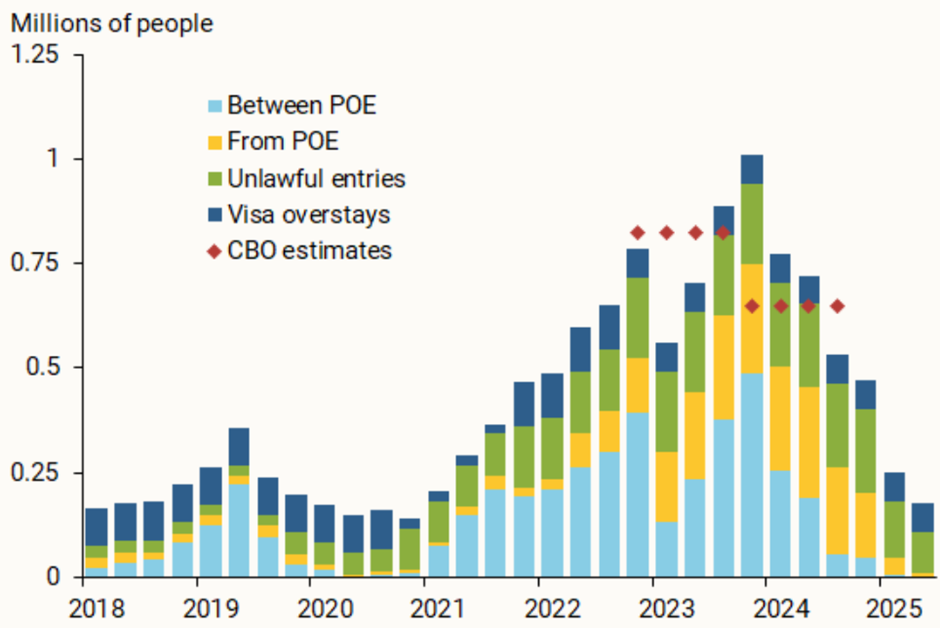

- Additionally, the significant reduction in the inflow of undocumented immigrants to the United States may contribute to maintaining a lower unemployment rate in the country, which, in turn, may foster wage gains and drive inflation by keeping demand higher.

Inflow of undocumented immigrants to the United States per quarter (million people)

Source: Federal Reserve of San Francisco.

Possible dissent: Although most FOMC members have shown consensus regarding the need for this more cautious stance, two members of the Fed Board of Governors have indicated that they believe the Committee should cut rates in this week’s decision: Christopher Waller and Michelle Bowman.

Pressure from the White House: The decision to keep interest rates stable is sure to provoke new criticism from the White House, which has increased its pressure campaign on Jerome Powell in an attempt to influence the agency's monetary policy decisions.

- U.S. President Donald Trump has been critical of Jerome Powell almost daily, frustrated by the Federal Open Market Committee's decisions not to cut U.S. interest rates.

Economic indicators in the U.S.

Expected impact on USDBRL: bullish

The week will feature the release of several economic indicators for the United States, such as the Employment Situation Report (“payroll”), Gross Domestic Product (GDP), Personal Consumption Expenses Price Index (PCE), and the Purchasing Managers Index (PMI) for the industrial sector.

Why this is important: The release of this data will help investors calibrate their expectations for the U.S. economic dynamics amid the enforcement of import tariffs imposed by the White House since April.

- The expectation of hotter data tends to reduce bets on interest rate cuts by the Federal Reserve in the short term, which favors the global appreciation of the dollar.

Overview: Despite fears about the existence of potential adverse impacts from trade measures on the performance of the US economy, the expectation of continued resilience and moderate inflation observed in recent data prevails.

- This perception, in turn, increases the expectations that US interest rates will remain higher for longer.

Expectations:

- Job market: The Employment Situation Report, the main release on the American labor market, is expected to signal a new slowdown in the pace of net job creation, with a median expectation of a balance of 110 thousand new jobs in July, compared to 147 thousand in the previous month. Despite the expected moderation, the numbers still do not indicate a more significant deterioration in the labor market, as it remains at a level considered healthy.

- Gross Domestic Product: The first preview of the PIB for the second quarter will be closely watched after the below-expected performance in the previous quarter, when it recorded an annualized decline of 0.5%. For the second quarter, recovery is projected, with annualized growth estimated at 2.5%.

- Industrial PMI: The indicator for July should remain slightly below the expansion line (50 points), with an expected reading around 49.6, after 49.0 in June. Although still in contractionary territory, the level signals continued moderate activity. Investors should closely watch the subcomponents, especially those tied to producer inflation and orders.

- Personal Consumption Expenditure (PCE) Price Index: The consumer inflation metric used by the Federal Reserve, the PCE, is expected to show a monthly increase of 0.3% in both the headline index and its core, which excludes the most volatile food and energy components. The moderate pick up in prices reinforces the view that the impacts of the tariffs have not yet broadly manifested in prices.

Copom interest rate decision

Expected impact on USDBRL: bullish

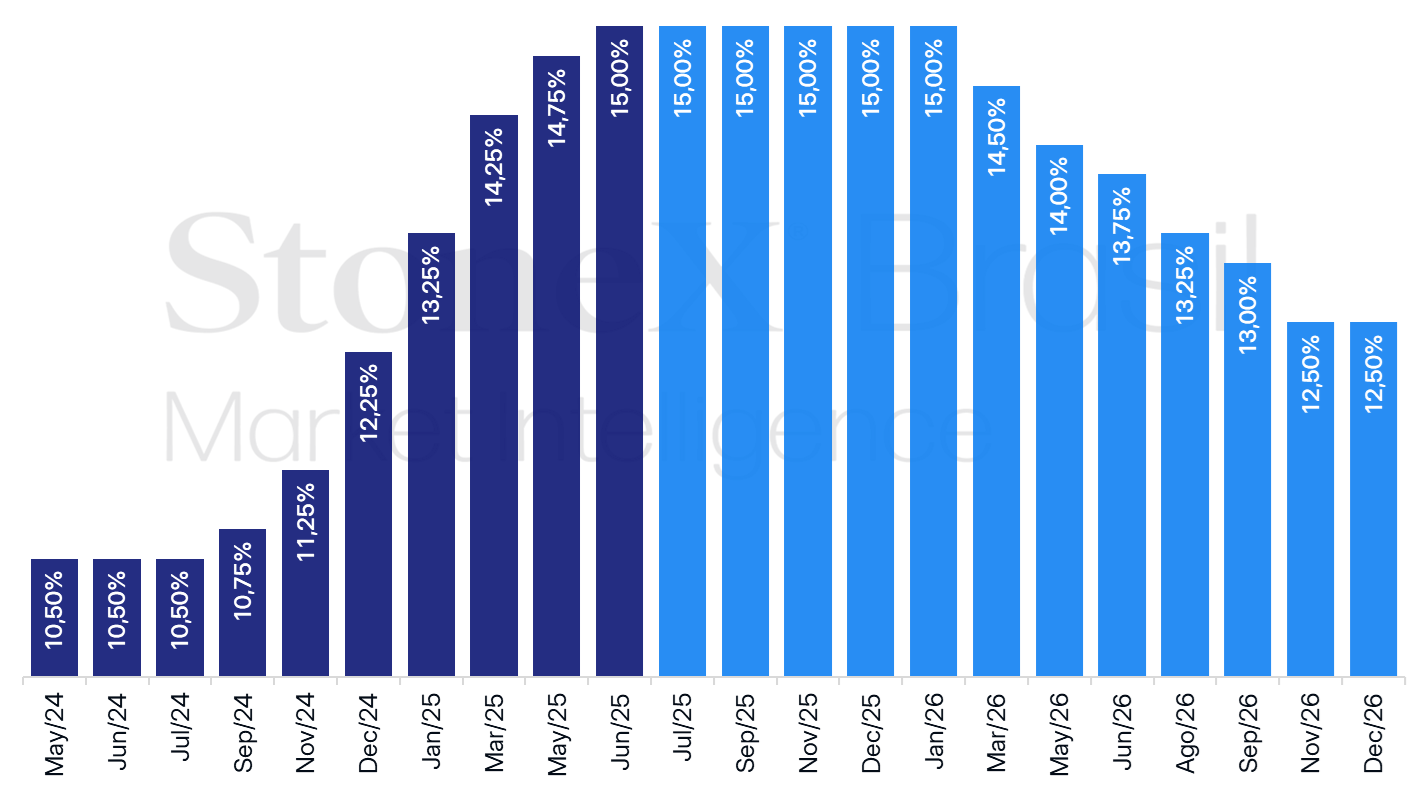

Brazil: History and expectation for the interest rate - Focus bulletin of July 18, 2025

Source: Central Bank of Brazil. Design: StoneX.

There is consensus among investors that the Monetary Policy Committee (Copom) of the Central Bank (BC) should keep the basic interest rate (Selic) unchanged at next Wednesday's meeting, remaining at 15.00% per year.

Why this is important: The expectation that the official statement on the decision will reinforce the signal of maintaining the Selic at a high level for a prolonged period tends to raise the return projections of Brazilian treasuries. This movement tends to foster the attractiveness of Brazilian assets, contributing to the appreciation of the real.

Overview: At the June meeting, Copom indicated that raising the Selic rate to 15.00% would mark the end of the monetary tightening cycle that began in September 2024.

- However, the persistence of inflation above the established target, which contrasts with concerns about the contractionary effects of interest rates on economic activity, keeps the degree of uncertainty regarding the future conduct of monetary policy high.

- In this context, market agents should pay attention to the announcement of the decision, which should provide clues about the next steps of the Central Bank and the time the rate will remain at this level.

- Therefore, during the week, investors should also follow the release of new economic data, especially for the labor market.

End-of-month Ptax rate

Expected impact on USDBRL: undefined

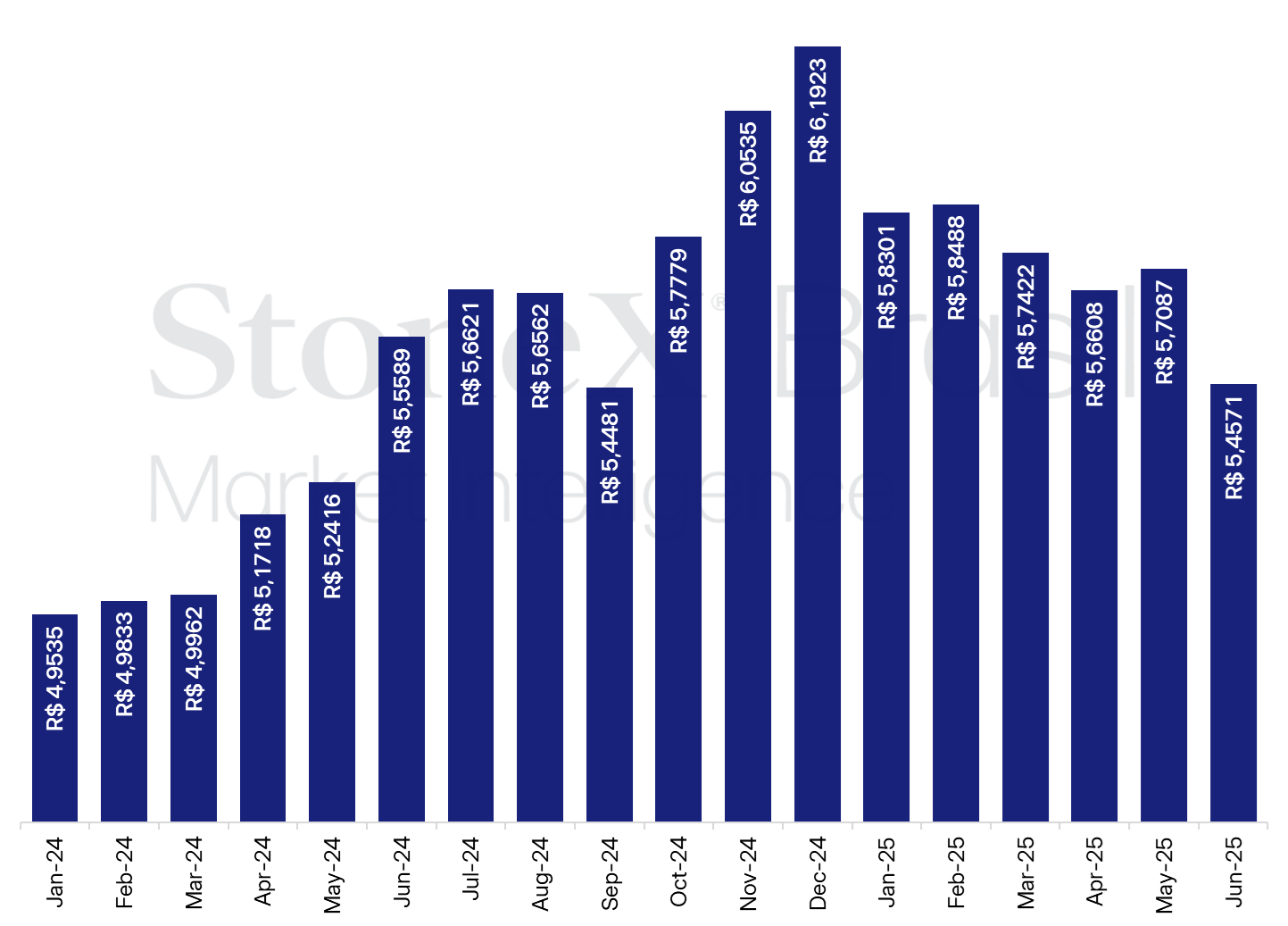

End-of-month PTAX rate – sale (R$/US$)

Source: Central Bank of Brazil. Design: StoneX.

The PTAX rate is a reference published daily by the Central Bank, and its end-of-month value is widely used in foreign exchange and derivatives contracts.

Why this is important: Financial market traders intensify their operations in the intervals of formation of the last Ptax rate of the month, which makes it difficult to read the movements of the real on the day.

- The volume of trades and volatility usually increase during the time windows used by the Central Bank of Brazil to calculate the end-of-month PTAX rate, between 10:00 AM and 1:10 PM.

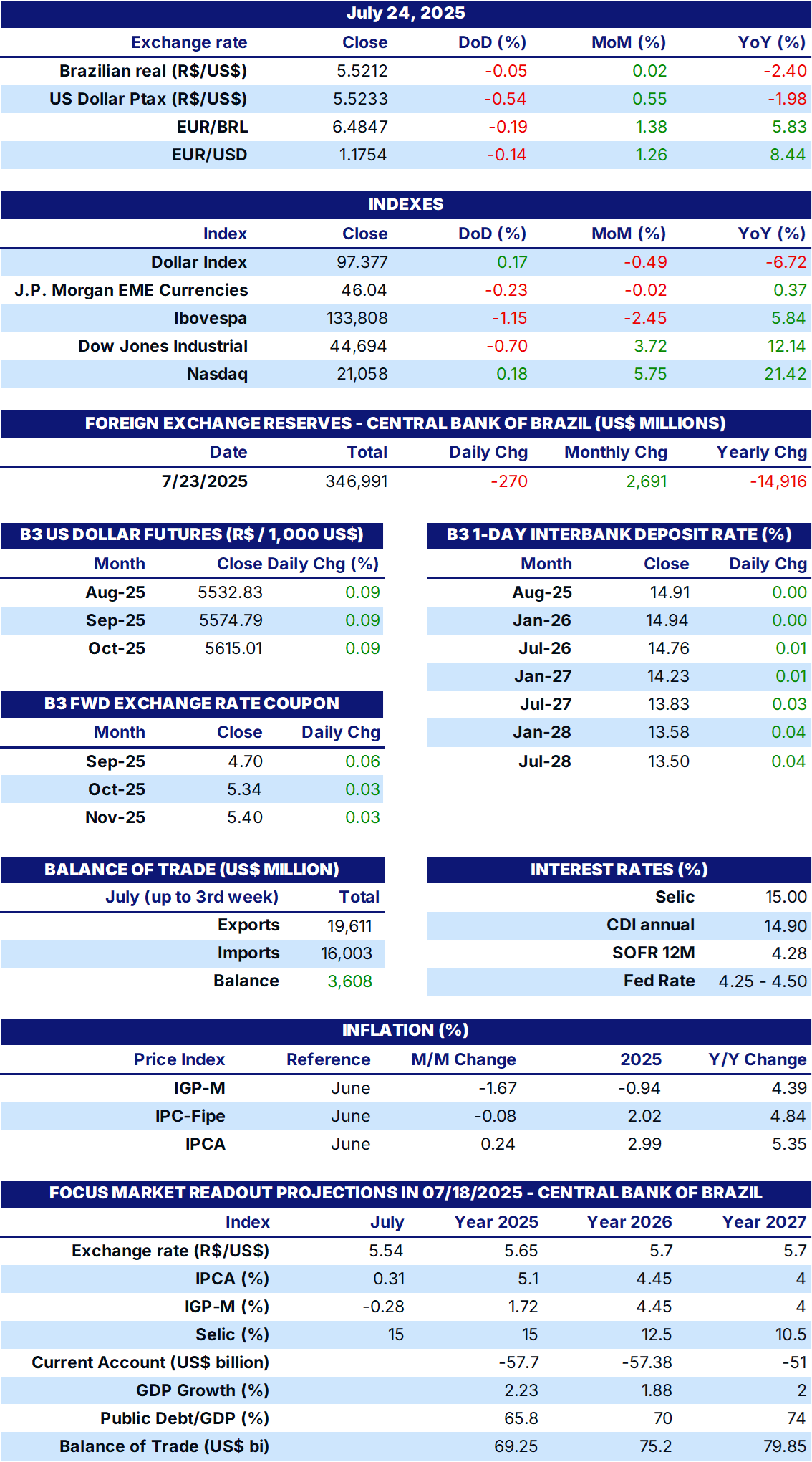

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.