- Bearish factors

- Investor skepticism about the magnitude and duration of the tariffs announced by the White House may boost demand for risky assets, favoring the real.

- Moderate inflation and no impact from tariffs in the United States may increase bets on interest rate cuts by the Federal Reserve and harm the attraction of financial investments in the country, weakening the dollar.

- Bullish factors

- Toughening of the American commercial stance may result in greater global risk aversion, which tends to depreciate the real.

- Threat of 50% US tariffs on Brazil may increase the perception of risks for Brazilian assets and harm the performance of the real.

- Clash between the Executive and Legislative over the increase in the IOF may increase the perception of fiscal risks for Brazilian assets and harm the performance of the real.

The week in review

• The White House has again announced tariffs for 23 trading partners and on copper imports.

• The tariffs ranged between 20% and 50% and take effect on August 1.

• Brazil unexpectedly received the highest tariff, of 50%, which decreased the country's export prospects and increased the perception of risks for national assets, devaluing the real.

• However, the reactions of the financial markets were muted, suggesting that investors believe that the president of the United States, Donald Trump, is bluffing by threatening higher tariffs.

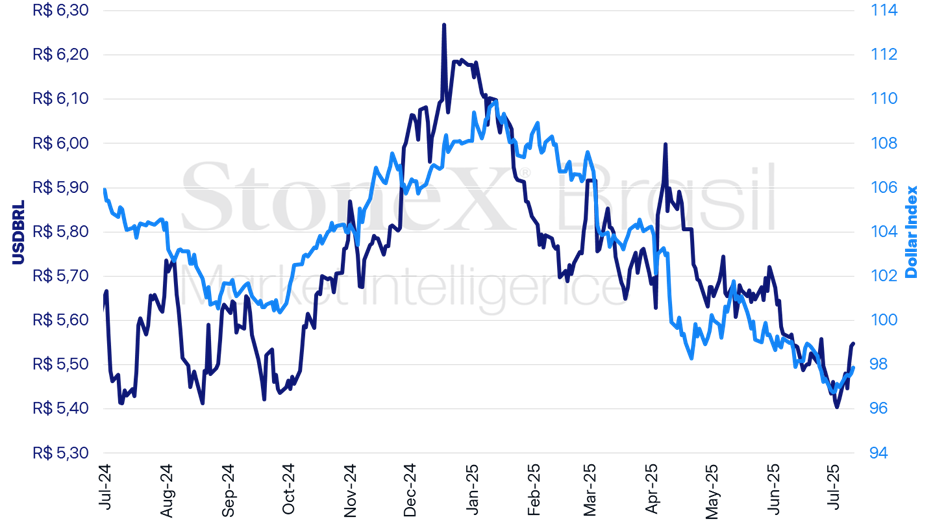

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

USDBRL | Daily: +0.11% | Weekly: +2.28% | Monthly: +2.08% | Year to date: -10.19% | In 12 months: +1.95% |

DXY | Daily: +0.29% | On the week: +0.91% | In the month: +1.06% | Year to date: -9.48% | In 12 months: -6.28% |

KEY EVENT: Threat of 50% tariffs on Brazil

Expected impact on USDBRL: bullish

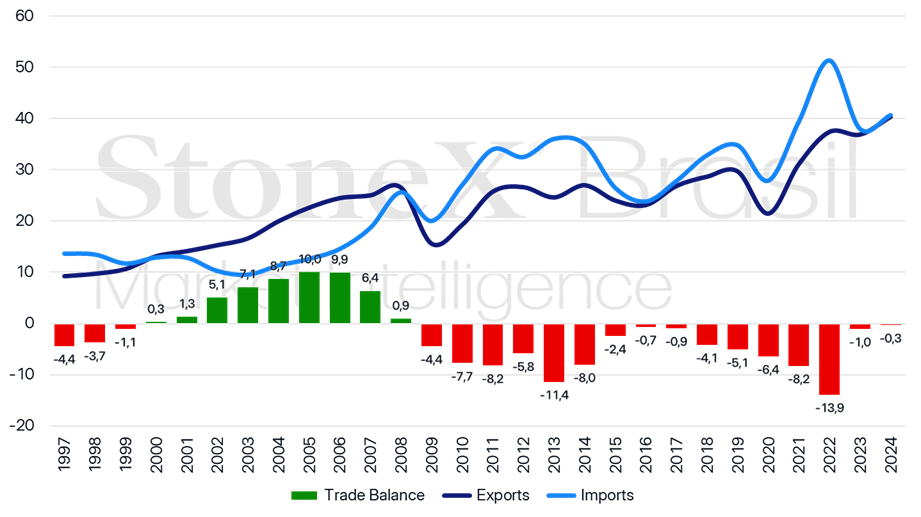

Exports, imports, and trade balance of Brazil with the United States (US$ bn)

Source: Comexstat. Design: StoneX.

The president of the United States, Donald Trump, announced import tariffs of 50% on all Brazilian products starting August 1.

Why this is important: Tariffs of this magnitude can severely harm Brazilian exports, since the US is currently the second largest destination for national exports. This would represent a reduction in the inflow of foreign currency, which tends to depreciate the real.

- Additionally, the decision increases unpredictability and the perception of risks for investments in Brazilian assets, which discourages foreign investments and likewise tends to devalue the real.

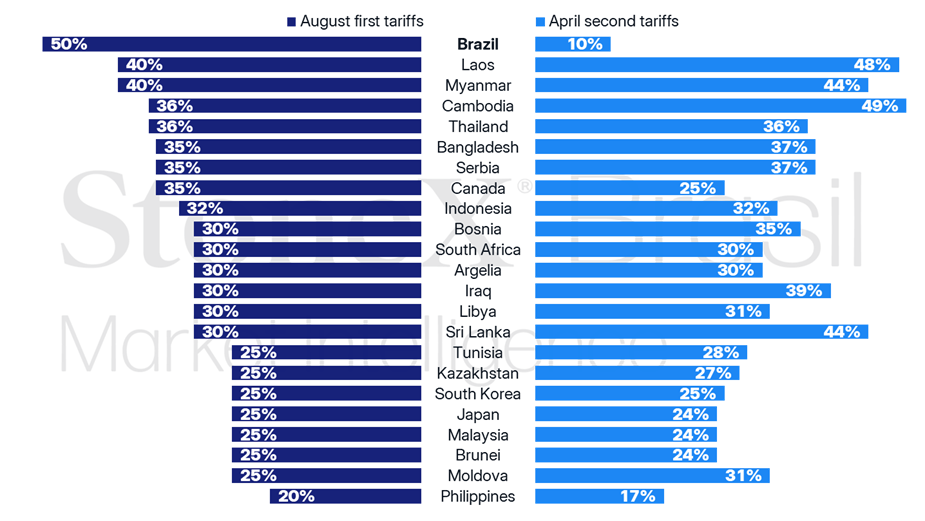

Punishing Brazil: Among the tariffs announced for August, the highest was for Brazil, at 50%.

- Trump attributed his decision to the “unfair” lawsuits against former president Jair Bolsonaro, to the “secret and illegal [court] censorship orders to US social media platforms,” and to “continuation attacks on the digital businesses of American companies.”

- The President of Brazil, Luiz Inácio Lula da Silva, in turn, said that Brazil will match any unilateral increase in tariffs based on the Economic Reciprocity Law, approved three months ago.

- The American taxation is disproportionate and difficult to justify, since the United States has recorded a trade surplus with Brazil since 2008.

What now? It is difficult to imagine a decrease in tensions between the two countries in the short term.

- By emphasizing national political and legal issues, Trump makes it difficult to find a commercial solution to the issue.

- Lula, in turn, showed himself willing to engage in the clash by suggesting that Brazil will retaliate against the tariff, which could drive Americans away from diplomatic trading.

- Although unlikely, these tensions may be reduced if Brazil and the United States manage to resume dialogue, which would foster a strengthening of the real.

New escalation of American trade tensions

Expected impact on USDBRL: bullish

American import tariffs by announcement date (%)

Source: White House. Design: StoneX.

Donald Trump once again increased trade tensions by unilaterally announcing higher import tariffs for 23 countries, as well as for copper imports.

- The tariffs ranged between 20% and 50% and take effect on August 1st.

- However, in general, financial markets showed contained movements, which imply that investors remain skeptical about the possibility of the White House drastically raising its import tariffs for a considerable time.

Why this is important: In theory, the tightening of the US commercial stance tends to fuel fears of a more intense slowdown in both the global and American economies, which, in turn, stimulates the search for assets considered “safe havens” in times of stress and tends to depreciate the real.

- On the other hand, the interpretation that Trump's threats lack credibility can act in the opposite direction and boost the performance of risky assets, such as the real.

Hardening the threats: In theory, the tariffs on imports should have returned to the values announced on April 2 last Thursday (10).

- However, Trump extended the deadline for a temporary reduction of almost all tariffs to 10% until the end of July and again announced new tariffs for a group of countries, without explaining how the new values were determined.

- The American president ruled out the possibility of a new extension of the temporary tariff reduction period, and warned that he will increase the tariffs of countries that impose tariffs on American products as retaliation.

- Additionally, the American president announced a 50% import tariff on copper, also starting from August 1.

The Boy Who Cried Wolf: However, the reactions of financial markets have been muted, suggesting that investors believe the president of the United States is bluffing by threatening higher tariffs, using the issue as a trading tool to pressure other countries into making trade deals.

- This interpretation stems from the inconsistent stance of the White House, which has already threatened, imposed, and then backed down on the application of import tariffs on several occasions.

- The new tariffs for the countries represent, in practice, yet another setback, since the increase in tariffs was postponed from July 10 to August 1.

- It is important to note, however, that this interpretation represents a bet by investors, and there are no guarantees that the White House does not intend to significantly toughen its commercial stance for a longer period.

Judicialization of IOF tax decrees and meeting between government and Congress

Expected impact on USDBRL: bullish

This Tuesday (15), officials from the Brazilian Administration, the Chamber of Deputies, and the Federal Senate are participating in a hearing for conciliation at the Supreme Federal Court (STF) to address the dispute regarding the Tax on Financial Operations (IOF).

- On July 4, STF minister Alexandre de Moraes suspended both the government decrees that increased the IOF tariffs and the parliamentary decree that annulled these increases.

Why this is important: The prolonged clash between the Executive and Legislative branches on the issue increases uncertainties regarding the management of fiscal policy and results in a greater perception of risks for Brazilian assets, which tends to depreciate the real.

- On the other hand, the possibility of a negotiated solution between the Powers may have the opposite effect and foster the performance of the real.

Overview: After the suspension of the decrees by Moraes, officials from the Executive and Legislative resumed dialogue last Tuesday (08), but did not reach a consensus.

- If, on the one hand, the judicialization of the issue by the Palácio do Planalto improved its trading conditions with Congress, the maneuver also risks aggravating the discontent of parliamentarians and further reducing the government's political articulation capacity.

Context: The attempt to increase federal revenue by raising the IOF caused wear for the federal government, which faced strong resistance from productive sectors and parliamentarians.

- The attempt at a negotiated solution with party leaders was unsuccessful, and Congress decided to nullify the increases and impose a defeat on the Executive.

- Subsequently, the government appealed to the judiciary to try to reverse the legislature's decision.

In summary: The uncertainty about the IOF tariffs and the impasse among the three branches of government may increase the perception of fiscal risks of Brazilian assets and contribute to a weakening of the real.

Inflation in the U.S

Expected impact on USDBRL: bearish

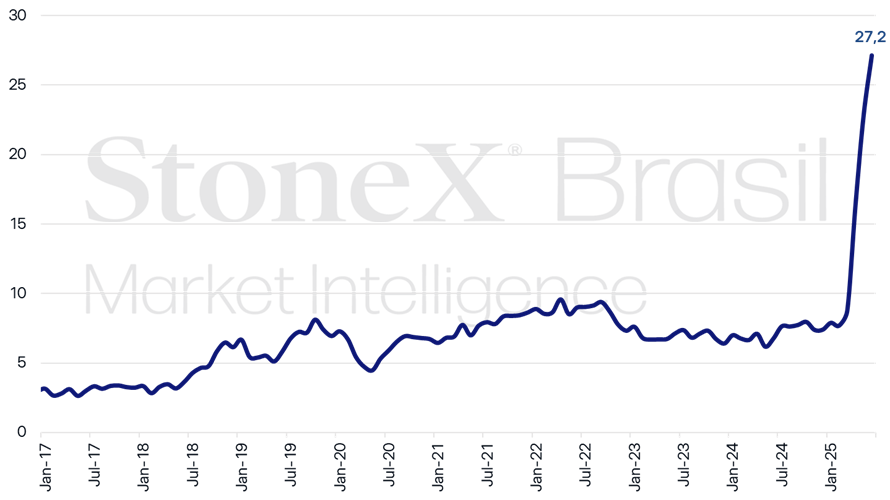

United States monthly customs revenue (US$ billion)

Source: U.S. Treasury Fiscal Data. Design: StoneX.

Consumer Price Index (CPI) and Producer Price Index (PPI) for June should accelerate slightly in June, but without showing signs of significant impacts from import tariffs.

Why this is important: The expectation of moderate inflation for both the American consumer and producer should reinforce the perception that the impacts of the tariffs recently implemented by the White House have been limited on domestic prices.

- This scenario, in turn, tends to strengthen bets on possible new interest rate cuts by the Federal Reserve and to contribute to a global depreciation of the dollar.

Expectation: The median of the projections points to a monthly pick up of the CPI, from 0.1% in May to 0.3% in June in both the headline index and its core, which excludes the most volatile food and energy items.

- For the PPI, the estimates also point to a slight pick up, with an increase of 0.2% in the month in both the headline index and the core, after a 0.1% rise in the previous month.

Overview: The data gain additional relevance because they occur after the "tariff shock" imposed by the US government in April.

- Although there was almost consensus among analysts that the increase in tariffs should accelerate inflation and slow down growth in the US, these impacts have been modest in the indicators available so far.

- This reading tends to be consolidated especially if the PPI does not reveal significant pressures on the prices of industrial goods, especially those most exposed to international trade.

- In parallel, the most recent data released by the US government reveal a pick up in customs revenues, indicating that the tariffs are already impacting import costs.

- In this sense, other American economic indicators released throughout the week should also serve as an important gauge for investors, with emphasis on the June retail sales data.

How to explain? The apparent contradiction between the rapid growth of customs revenues and the modest impact on inflation still puzzles analysts.

- One possibility is that U.S. companies are limiting pass-throughs of higher import costs, compressing their margins.

- It is also possible that foreign exporters have agreed to lower their prices to sustain their sales, squeezing their margins.

- It is also possible that American companies anticipated imports and increased stocks before the adoption of the tariffs, and that their total stocks costs have not yet risen significantly.

- It is also considered that the possibility that the projections of the impacts of the tariffs on the final prices of the products may have been overestimated.

In summary: If the limited rise in inflation rates is confirmed, bets may grow for interest rate cuts to be carried out by the Federal Reserve at the agency's next monetary policy meetings. This, in turn, tends to devalue the dollar globally, which favors the real.

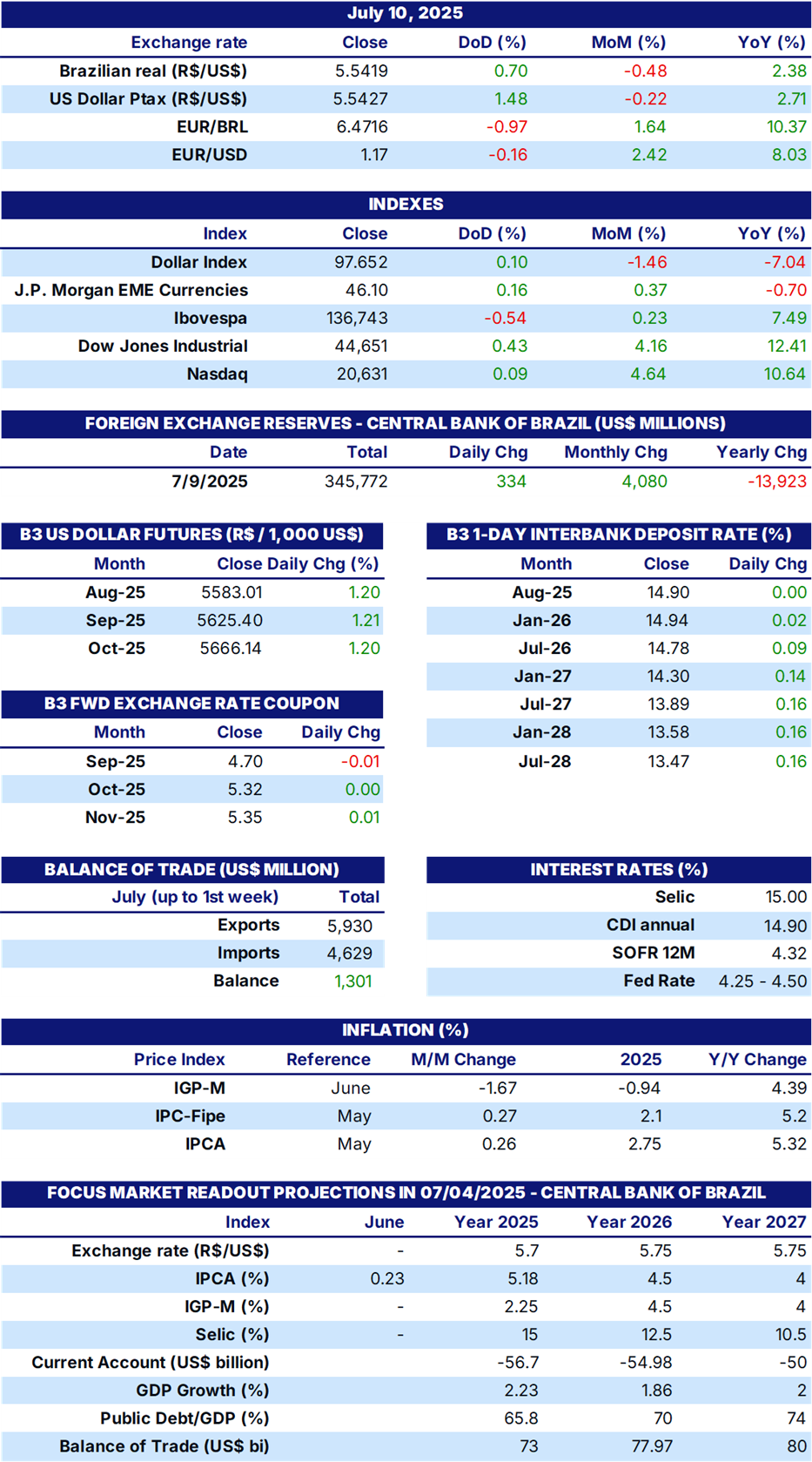

INDICATORS

Source: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.